Rite Aid 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

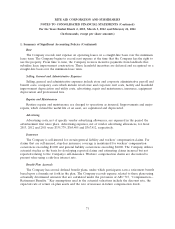

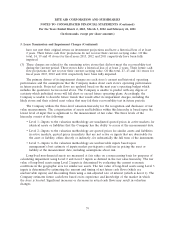

3. Lease Termination and Impairment Charges (Continued)

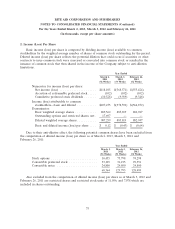

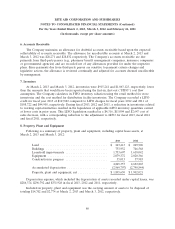

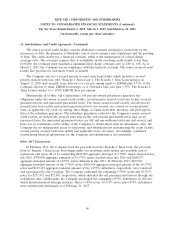

impairment of assets at these locations. The following table reflects the closed store and distribution

center charges that relate to new closures, changes in assumptions and interest accretion:

Year Ended

March 2, March 3, February 26,

2013 2012 2011

(52 Weeks) (53 Weeks) (52 Weeks)

Balance—beginning of year ................ $367,864 $405,350 $ 412,654

Provision for present value of noncancellable

lease payments of closed stores .......... 14,440 11,832 51,369

Changes in assumptions about future sublease

income, terminations and change in interest

rates ............................. 9,023 11,305 19,585

Interest accretion ...................... 23,246 26,084 26,234

Cash payments, net of sublease income ...... (90,816) (86,707) (104,492)

Balance—end of year ..................... $323,757 $367,864 $ 405,350

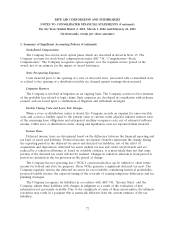

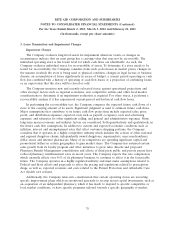

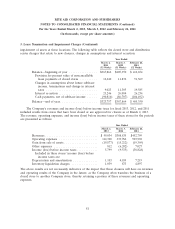

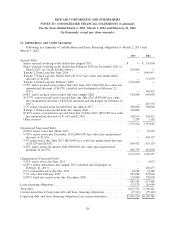

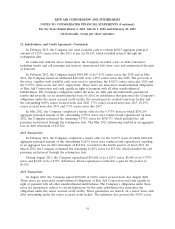

The Company’s revenues and income (loss) before income taxes for fiscal 2013, 2012, and 2011

included results from stores that have been closed or are approved for closure as of March 2, 2013.

The revenue, operating expenses, and income (loss) before income taxes of these stores for the periods

are presented as follows:

Year Ended

March 2, March 3, February 26,

2013 2012 2011

Revenues .............................. $ 99,034 $308,835 $452,799

Operating expenses ...................... 112,300 339,784 503,969

Gain from sale of assets ................... (19,877) (15,212) (19,369)

Other expenses ......................... 812 (6,202) 7,027

Income (loss) before income taxes ............ 5,799 (9,535) (38,828)

Included in these stores’ income (loss) before

income taxes are:

Depreciation and amortization .............. 1,103 4,189 7,219

Inventory liquidation charges ............... 1,039 873 4,897

The above results are not necessarily indicative of the impact that these closures will have on revenues

and operating results of the Company in the future, as the Company often transfers the business of a

closed store to another Company store, thereby retaining a portion of these revenues and operating

expenses.

81