Rite Aid 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

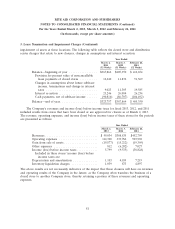

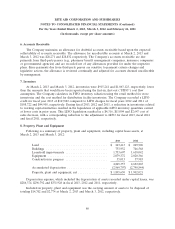

11. Indebtedness and Credit Agreement (Continued)

The senior secured credit facility contains additional covenants which place restrictions on the

incurrence of debt, the payments of dividends, sale of assets, mergers and acquisitions and the granting

of liens. The credit facility has a financial covenant, which is the maintenance of a fixed charge

coverage ratio. The covenant requires that, if availability on the revolving credit facility is less than

$150,000, the Company must maintain a minimum fixed charge coverage ratio of 1.00 to 1.00. As of

March 2, 2013, the Company was in compliance with this financial covenant. The senior secured credit

facility also provides for customary events of default.

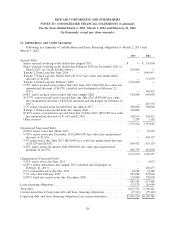

The Company also has a second priority secured term loan facility, which includes a second

priority secured term loan (the ‘‘Tranche 1 Term Loan’’). The Tranche 1 Term Loan matures on

August 21, 2020 and currently bears interest at a rate per annum equal to LIBOR plus 4.75%, if the

Company chooses to make LIBOR borrowings, or at Citibank’s base rate plus 3.75%. The Tranche 6

Term Loan is subject to a 1.00% LIBOR floor per annum.

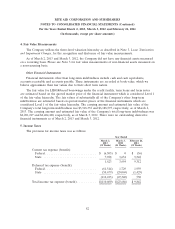

Substantially all of Rite Aid Corporation’s 100 percent owned subsidiaries guarantee the

obligations under the senior secured credit facility, second priority secured term loan facility, secured

guaranteed notes and unsecured guaranteed notes. The senior secured credit facility, second priority

secured term loan facility and secured guaranteed notes are secured, on a senior or second priority

basis, as applicable, by a lien on, among other things, accounts receivable, inventory and prescription

files of the subsidiary guarantors. The subsidiary guarantees related to the Company’s senior secured

credit facility, second priority secured term loan facility and secured guaranteed notes and, on an

unsecured basis, the unsecured guaranteed notes are full and unconditional and joint and several, and

there are no restrictions on the ability of the Company to obtain funds from its subsidiaries. Also, the

Company has no independent assets or operations, and subsidiaries not guaranteeing the credit facility,

second priority secured term loan facility and applicable notes are minor. Accordingly, condensed

consolidating financial information for the Company and subsidiaries is not presented.

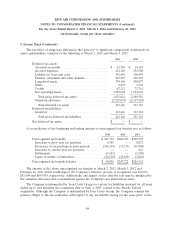

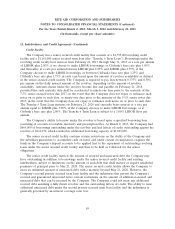

Other 2013 Transactions

In February 2013, the Company used the proceeds from the Tranche 6 Term Loan, the proceeds

from its Tranche 1 Term Loan, borrowings under our revolving credit facility and available cash to

repurchase and repay all of its outstanding $410,000 aggregate principal of 9.750% senior secured notes

due 2016, $470,000 aggregate principal of 10.375% senior secured notes due 2016 and $180,277

aggregate principal amount of 6.875% senior debentures due 2013. In February 2013, $257,261

aggregate principal amount of the 9.750% notes, $401,999 aggregate principal amount of the 10.375%

notes and $119,119 aggregate principal amount of the 6.875% debentures, respectively, were tendered

and repurchased by the Company. The Company redeemed the remaining 9.750% notes and 10.375%

notes for $171,432 and $72,901, respectively, which included the call premium and interest through the

redemption date. Additionally, the Company discharged the remaining 6.875% debentures for $63,416,

which included interest through maturity. These 9.750% notes, 10.375% notes and 6.875% debentures

were satisfied and discharged as of February 21, 2013.

90