Rite Aid 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

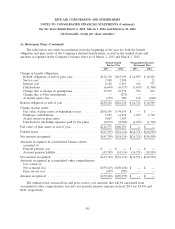

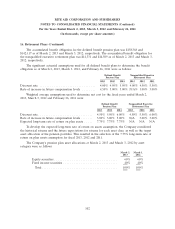

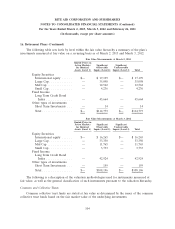

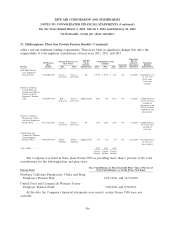

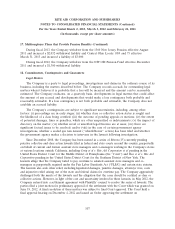

16. Retirement Plans (Continued)

compensation. Total expense recognized for the above plans was $56,480 in fiscal 2013, $57,036 in fiscal

2012 and $58,035 in fiscal 2011.

The Company sponsors a Supplemental Executive Retirement Plan (‘‘SERP’’) for its officers,

which is a defined contribution plan that is subject to a five year graduated vesting schedule. The

expense recognized for the SERP was $7,469 in fiscal 2013, $4,582 in fiscal 2012, and $9,433 in fiscal

2011.

Defined Benefit Plans

The Company and its subsidiaries also sponsor a qualified defined benefit pension plan that

requires benefits to be paid to eligible associates based upon years of service and, in some cases,

eligible compensation. The Company’s funding policy for The Rite Aid Pension Plan (The ‘‘Defined

Benefit Pension Plan’’) is to contribute the minimum amount required by the Employee Retirement

Income Security Act of 1974. However, the Company may, at its sole discretion, contribute additional

funds to the plan. The Company made contributions of $5,583 in fiscal 2013, $14,878 in fiscal 2012, and

$13,451 in fiscal 2011.

The Company also maintains a nonqualified executive retirement plan for certain former

employees who, pursuant to their employment agreements, did not participate in the SERP. The

Company no longer enrolls new participants into this plan. These participants generally receive an

annual benefit payable monthly over fifteen years. This nonqualified defined benefit plan is unfunded.

99