Rite Aid 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the senior secured credit facility. These guarantees are shared, on a senior basis, with debt outstanding

under the senior secured credit facility. The indenture that governs the 8.00% notes contains covenant

provisions that, among other things, allow the holders of the notes to participate along with the term

loan holders in the mandatory prepayments resulting from the proceeds of certain asset dispositions (at

the option of the noteholder) and include limitations on our ability to pay dividends, make investments

or other restricted payments, incur debt, grant liens, sell assets and enter into sale-leaseback

transactions.

In July 2010, we repurchased $93.8 million of our $158.0 million outstanding 8.5% convertible

notes. The remaining 8.5% convertible notes require us to maintain a listing on the NYSE or certain

other exchanges. In the event of a NYSE delisting, holders of these notes could require us to

repurchase them, which we have the ability to do under the terms of our senior secured credit facility.

We are currently in compliance with all NYSE listing rules.

As of March 2, 2013, we had no material off balance sheet arrangements, other than operating

leases included in the table below.

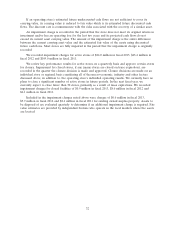

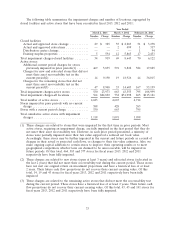

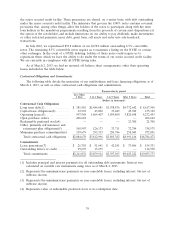

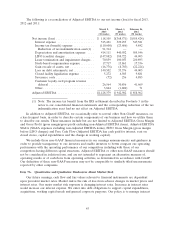

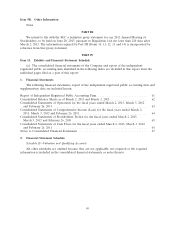

Contractual Obligations and Commitments

The following table details the maturities of our indebtedness and lease financing obligations as of

March 2, 2013, as well as other contractual cash obligations and commitments.

Payment due by period

Less Than

1 Year 1 to 3 Years 3 to 5 Years After 5 Years Total

(Dollars in thousands)

Contractual Cash Obligations

Long term debt(1) .............. $ 381,910 $1,484,081 $1,978,876 $4,772,642 $ 8,617,509

Capital lease obligations(2) ........ 32,992 43,002 33,249 45,949 155,192

Operating leases(3) ............. 997,548 1,864,407 1,589,800 3,820,698 8,272,453

Open purchase orders ........... 406,642 — — — 406,642

Redeemable preferred stock(4) .....———21,300 21,300

Other, primarily self insurance and

retirement plan obligations(5) .... 105,907 126,173 33,711 72,784 338,575

Minimum purchase commitments(6) . 159,679 295,333 259,746 258,043 972,801

Total contractual cash obligations . $2,084,678 $3,812,996 $3,895,382 $8,991,416 $18,784,472

Commitments

Lease guarantees(7) ............. $ 26,703 $ 51,641 $ 42,181 $ 33,806 $ 154,331

Outstanding letters of credit ....... 99,695 15,275 — — 114,970

Total commitments ............ $2,211,076 $3,879,912 $3,937,563 $9,025,222 $19,053,773

(1) Includes principal and interest payments for all outstanding debt instruments. Interest was

calculated on variable rate instruments using rates as of March 2, 2013.

(2) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(3) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(4) Represents value of redeemable preferred stock at its redemption date.

39