Rite Aid 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

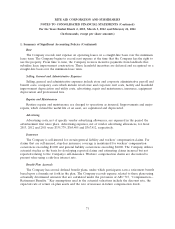

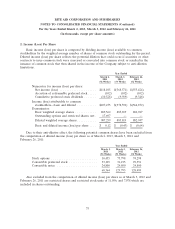

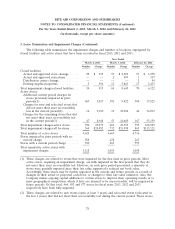

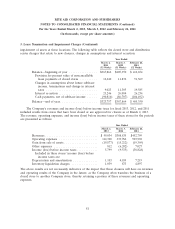

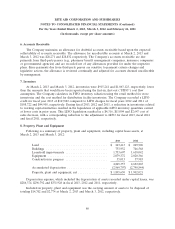

3. Lease Termination and Impairment Charges (Continued)

The following table summarizes the impairment charges and number of locations, segregated by

closed facilities and active stores that have been recorded in fiscal 2013, 2012 and 2011:

Year Ended

March 2, 2013 March 3, 2012 February 26, 2011

Number Charge Number Charge Number Charge

Closed facilities:

Actual and approved store closings ..... 29 $ 325 55 $ 2,283 51 $ 3,278

Actual and approved relocations ....... — — 2 499 1 317

Distribution center closings ........... — — — — 1 94

Existing surplus properties ............ 5 594 12 5,863 17 2,433

Total impairment charges-closed facilities . . . 34 919 69 8,645 70 6,122

Active stores:

Additional current period charges for

stores previously impaired in prior

periods(1) ...................... 469 5,835 591 9,822 584 17,825

Charges for new and relocated stores that

did not meet their asset recoverability

test in the current period(2) ......... 14 9,190 19 18,926 44 36,015

Charges for the remaining stores that did

not meet their asset recoverability test

in the current period(3) ............ 47 8,948 53 14,605 167 55,159

Total impairment charges-active stores ..... 530 23,973 663 43,353 795 108,999

Total impairment charges-all locations ..... 564 $24,892 732 $51,998 865 $115,121

Total number of active stores ........... 4,623 4,667 4,714

Stores impaired in prior periods with no

current charge .................... 588 428 263

Stores with a current period charge ....... 530 663 795

Total cumulative active stores with

impairment charges ................. 1,118 1,091 1,058

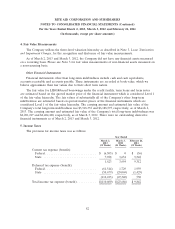

(1) These charges are related to stores that were impaired for the first time in prior periods. Most

active stores, requiring an impairment charge, are fully impaired in the first period that they do

not meet their asset recoverability test. However, in each prior period presented, a minority of

stores were partially impaired since their fair value supported a reduced net book value.

Accordingly, these stores may be further impaired in the current and future periods as a result of

changes in their actual or projected cash flows, or changes to their fair value estimates. Also, the

Company makes ongoing capital additions to certain stores to improve their operating results or to

meet geographical competition, which if later are deemed to be unrecoverable, will be impaired in

future periods. Of this total, 464, 583 and 577 stores for fiscal years 2013, 2012 and 2011

respectively have been fully impaired.

(2) These charges are related to new stores (open at least 3 years) and relocated stores (relocated in

the last 2 years) that did not meet their recoverability test during the current period. These stores

78