Rite Aid 2013 Annual Report Download - page 39

Download and view the complete annual report

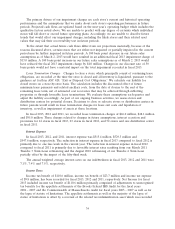

Please find page 39 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.available cash to repurchase and repay all of our outstanding $410.0 million aggregate principal of

9.750% senior secured notes due 2016, $470.0 million aggregate principal of 10.375% senior secured

notes due 2016 and $180.3 million aggregate principal amount of 6.875% senior debentures due 2013.

In February 2013, $257.3 million aggregate principal amount of the 9.750% notes, $402.0 million

aggregate principal amount of the 10.375% notes and $119.1 million aggregate principal amount of the

6.875% debentures, respectively, were tendered and repurchased by us. We redeemed the remaining

9.750% notes and 10.375% notes for $171.4 million and $72.9 million, respectively, which included the

call premium and interest through the redemption date. Additionally, we discharged the remaining

6.875% debentures for $63.4 million, which included interest through maturity. These 9.750% notes,

10.375% notes and 6.875% debentures were satisfied and discharged as of February 21, 2013.

In February 2013, we also used available cash to redeem our $6.0 million aggregate principal

amount of 9.25% senior notes due 2013 at par for $6.1 million, which included interest through the

redemption date.

In connection with the above transactions, we recorded a loss on debt retirement of $122.7 million

during the fourth quarter of fiscal 2013 due to the incurrence of tender and call premiums and interest

to maturity of $62.9 million, unamortized original issuance discount of $24.3 million and unamortized

debt issue costs of $35.5 million.

In February 2012, we issued $481.0 million of our 9.25% senior notes due March 2020 and in May

2012, we issued an additional $421.0 million of our 9.25% senior notes due 2020. The proceeds of the

notes, together with available cash, were used to repurchase and repay the 8.625% senior notes due

2015 and the 9.375% senior notes due 2015, respectively. These notes are unsecured, unsubordinated

obligations of Rite Aid Corporation and rank equally in right of payment with all other unsubordinated

indebtedness. Our obligations under the notes are fully and unconditionally guaranteed, jointly and

severally, on an unsecured unsubordinated basis, by all of our subsidiaries that guarantee our

obligations under our senior secured credit facility, our second priority secured term loan facility and

our outstanding 8.00% senior secured notes due 2020, 7.5% senior secured notes due 2017, 10.25%

senior secured notes due 2019 and 9.5% senior notes due 2017.

In May 2012, $296.3 million aggregate principal amount of the outstanding 9.375% notes were

tendered and repurchased by us. We redeemed the remaining 9.375% notes in June 2012 for

$108.7 million, which included the call premium and interest through the redemption date. The

refinancing resulted in an aggregate loss on debt retirement of $17.8 million.

2012 Transactions

In February 2012, $404.8 million aggregate principal amount of the outstanding 8.625% notes were

tendered and repurchased by us. We redeemed the remaining 8.625% notes in March 2012 for

$55.6 million, which included the call premium and interest through the redemption date. The

refinancing resulted in an aggregate loss on debt retirement of $16.1 million recorded in the fourth

quarter of fiscal 2012.

During August 2011, we repurchased $41.0 million of our 8.625% notes, $5.0 million of our

9.375% notes and $4.5 million of our 6.875% debentures. These repurchases resulted in a gain for the

period of $5.0 million.

2011 Transactions

In August 2010, we issued $650.0 million of our 8.00% senior secured notes due August 2020.

These notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in

right of payment with all other unsubordinated indebtedness. Our obligations under these notes are

guaranteed, subject to certain limitations, by the same subsidiaries that guarantee the obligations under

38