Rite Aid 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If an operating store’s estimated future undiscounted cash flows are not sufficient to cover its

carrying value, its carrying value is reduced to fair value which is its estimated future discounted cash

flows. The discount rate is commensurate with the risks associated with the recovery of a similar asset.

An impairment charge is recorded in the period that the store does not meet its original return on

investment and/or has an operating loss for the last two years and its projected cash flows do not

exceed its current asset carrying value. The amount of the impairment charge is the entire difference

between the current carrying asset value and the estimated fair value of the assets using discounted

future cash flows. Most stores are fully impaired in the period that the impairment charge is originally

recorded.

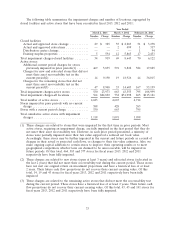

We recorded impairment charges for active stores of $24.0 million in fiscal 2013, $43.4 million in

fiscal 2012 and $109.0 million in fiscal 2011.

We review key performance results for active stores on a quarterly basis and approve certain stores

for closure. Impairment for closed stores, if any (many stores are closed on lease expiration), are

recorded in the quarter the closure decision is made and approved. Closure decisions are made on an

individual store or regional basis considering all of the macro-economic, industry and other factors

discussed above, in addition to, the operating store’s individual operating results. We currently have no

plans to close a significant number of active stores in future periods. In the next fiscal year, we

currently expect to close fewer than 50 stores, primarily as a result of lease expirations. We recorded

impairment charges for closed facilities of $0.9 million in fiscal 2013, $8.6 million in fiscal 2012 and

$6.1 million in fiscal 2011.

Included in the impairment charges noted above were charges of $0.6 million in fiscal 2013,

$5.9 million in fiscal 2012 and $2.4 million in fiscal 2011 for existing owned surplus property. Assets to

be disposed of are evaluated quarterly to determine if an additional impairment charge is required. Fair

value estimates are provided by independent brokers who operate in the local markets where the assets

are located.

32