Redbox 2012 Annual Report Download - page 87

Download and view the complete annual report

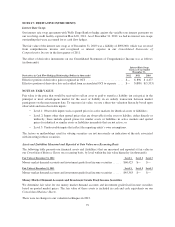

Please find page 87 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Assets and Liabilities Measured and Reported at Fair Value on a Nonrecurring Basis

We recognize or disclose the fair value of certain assets such as notes receivable and non-financial assets,

primarily long-lived assets, goodwill, intangible assets and certain other assets in connection with impairment

evaluations. All of our nonrecurring valuations use significant unobservable inputs and therefore fall under Level

3 of the fair value hierarchy.

Trademarks License

During the first quarter of 2012, Redbox granted the Joint Venture a limited, non-exclusive, non-transferable,

royalty-free right and license to use certain Redbox trademarks. The preliminary estimated fair value of the

trademarks was approximately $30.0 million as of the date of grant based on the relief-from-royalty method. We

estimated the preliminary fair value using the information available on the grant date, which consisted of the

expected future discounted and tax-effected cash flows attributable to the projected gross revenue stream of the

Joint Venture, estimated market royalty rates of approximately 1.5%, as well as a discount rate of approximately

45.0%, which reflected our view of the risks and uncertainties associated with an early development stage entity.

See Note 5: Equity Method Investments and Related Party Transactions.

Notes Receivable

During 2011, we financed a portion of the proceeds from the sale of our Money Transfer Business through a note

receivable with Sigue (the “Sigue Note”). We estimated the fair value of the Sigue Note based on the future note

payments discounted at a market rate for similar risk profile companies, approximately 18.0%, which reflected

our best estimate of default risk, and was not an exit price based measure of fair value or the stated value on the

face of the Sigue Note. We evaluate the Sigue Note for collectability on a quarterly basis. Based on our

evaluation at December 31, 2012, an allowance for credit losses was not established. We recognized interest

income on the Sigue Note on an accrual basis based on the imputed interest rate unless it is determined that

collection of all principal and interest is unlikely. As of December 31, 2012, the carrying value of the Sigue Note

approximated its estimated fair value and was reported in our Consolidated Balance Sheets. See Note 12:

Discontinued Operations and Sale of a Business for additional information about the sale of our Money Transfer

Business.

Long-Lived Assets, Goodwill and Other Intangible Assets

During the second quarter of 2011, we performed nonrecurring fair value measurements in connection with

assigning goodwill to our segments. We used a relative fair value approach that is similar to the approach used

when a portion of a segment is to be disposed. We used both the income and cost methods to estimate the fair

value of our New Ventures segment and both the income and market methods to estimate the fair values of our

Redbox and Coin segments.

Fair Value of Other Financial Instruments

The carrying value of our term loan approximates its fair value and falls under Level 2 of the fair value

hierarchy.

We estimate the fair value of our convertible debt outstanding using a market rate of approximately 4.5% and

7.6%, for similar high-yield debt at December 31, 2012 and December 31, 2011, respectively. The estimated fair

value of our convertible debt was approximately $183.7 million and $183.4 million at December 31, 2012 and

December 31, 2011, respectively, and was determined based on its stated terms, maturing on September 1, 2014,

and an annual interest rate of 4.0%. The fair value estimate of our convertible debt falls under Level 3 of the fair

value hierarchy. We have reported the carrying value of our convertible debt, face value less the unamortized

debt discount, in our Consolidated Balance Sheets.

80