Redbox 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reclassifications

We have reclassified certain results from the prior year to be consistent with our current year presentation. The

reclassifications included in our Consolidated Statements of Comprehensive Income were as follows:

• Presentation of the components of other comprehensive income before related tax effects with one

amount shown for the aggregate income tax effect; and

• Separate presentation of income or loss from equity method investments.

These reclassifications had no effect on our consolidated financial position, results of operations, or cash flows.

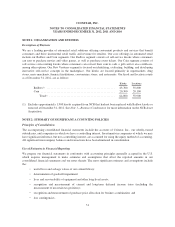

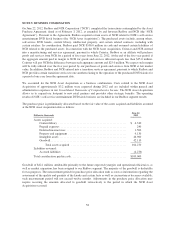

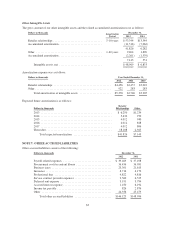

Revision of Previously Issued Financial Statements

During the second quarter of 2012, we identified a $17.1 million adjustment related to the 2009 disposition of our

entertainment services business. The adjustment was determined to be an immaterial error in the calculation of a

worthless stock deduction which resulted in an overstatement of our noncurrent deferred income tax asset and

income from discontinued operations, net of tax, in our 2009 year-end financial statements. We concluded that

the error was not material to any of our prior period financial statements under the guidance of SEC Staff

Accounting Bulletin (“SAB”) No. 99, Materiality primarily because it does not impact any known trends we

consider meaningful. Although the error was and continues to be immaterial to prior periods, because of the

significance of the out-of-period correction in the second quarter of 2012, we applied the guidance of SAB

No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in the Current

Year Financial Statements, and revised our prior period financial statements.

In addition to a decrease of $17.1 million in our retained earnings on March 31, 2012, and December 31, 2011,

we have revised our 2009 year-end financial statements in the following tables:

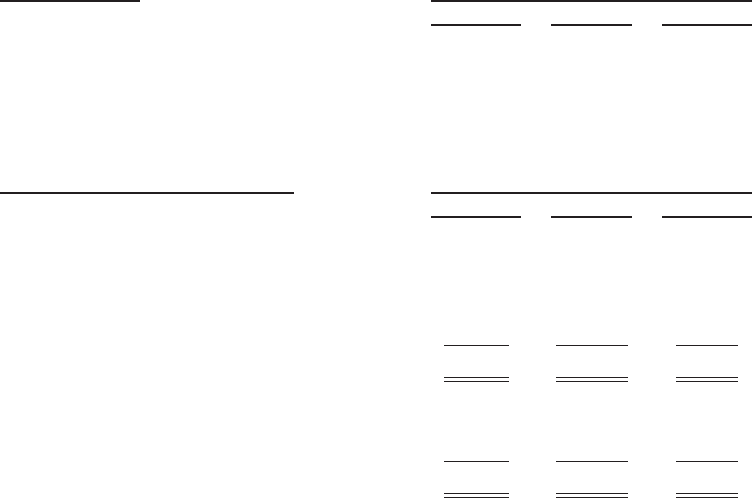

Dollars in thousands December 31, 2009

As Reported Adjustment As Revised

Noncurrent deferred income tax assets ......... $ 99,195 $(17,113) $ 82,082

Total assets .............................. $1,222,799 $(17,113) $1,205,686

Retained earnings ......................... $ 50,971 $(17,113) $ 33,858

Total equity .............................. $ 412,391 $(17,113) $ 395,278

Total liabilities and stockholder’s equity ....... $1,222,799 $(17,113) $1,205,686

Dollars in thousands, except per share data Year Ended December 31, 2009

As Reported Adjustment As Revised

Income (loss) from discontinued operation, net of

tax ................................... $13,577 $(17,113) $(3,536)

Basic earnings (loss) per share:

Continuing operations .................. $ 1.33 $ — $ 1.33

Discontinued operations ................ 0.45 (0.56) (0.11)

Basic earnings (loss) per share ............... $ 1.78 $ (0.56) $ 1.22

Diluted earnings (loss) per share:

Continuing operations .................. $ 1.31 $ — $ 1.31

Discontinued operations ................ 0.45 (0.56) (0.11)

Diluted earnings (loss) per share .............. $ 1.76 $ (0.56) $ 1.20

57