Redbox 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

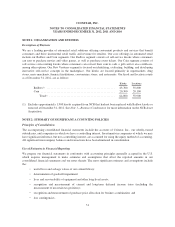

Loss Contingencies

We accrue estimated liabilities for loss contingencies arising from claims, assessments, litigation and other

sources when it is probable that a liability has been incurred and the amount of the claim assessment or damages

can be reasonably estimated. We believe that we have sufficient accruals to cover any obligations resulting from

claims, assessments or litigation that have met these criteria.

Accounting Pronouncements Not Yet Effective

In July 2012, the FASB issued ASU No. 2012-02, “Intangibles—Goodwill and Other (Topic 350): Testing

Indefinite-Lived Intangible Assets for Impairment.” ASU 2012-02 allows an entity to first assess qualitative

factors to determine whether it is necessary to perform the quantitative impairment test for indefinite-lived

intangible assets. An organization that elects to perform a qualitative assessment no longer is required to perform

the quantitative impairment test for an indefinite-lived intangible asset if it is more likely than not that the asset is

impaired. The ASU, which applies to all public, private, and not-for-profit organizations, is effective for annual

and interim impairment tests performed for fiscal years beginning after September 15, 2012. We do not believe

our adoption of ASU 2012-02 in the first quarter of 2013 will have a material impact on our financial position,

results of operations or cash flows.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Variable Rates of Interest

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of our

credit facility agreement with a syndicate of lenders led by Bank of America, N.A. and investment activities that

generally bear interest at variable rates. Because our investments have maturities of three months or less and our

credit facility interest rates are based upon either the LIBOR, prime rate or base rate plus an applicable margin,

we believe that the risk of material loss is low and that the carrying amount of these balances approximates fair

value.

Based on the balance of our outstanding term loan of $159.7 million as of December 31, 2012, an increase or

decrease of 1 percentage point in the interest rate over the next year would increase or decrease our annual

interest expense by approximately $1.0 million, net of tax.

Foreign Exchange Rate Fluctuation

We are subject to the risk of foreign exchange rate fluctuation in the normal course of business as a result of our

operations in the United Kingdom, Ireland, and Canada.

42