Redbox 2012 Annual Report Download - page 31

Download and view the complete annual report

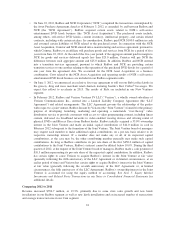

Please find page 31 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• On June 22, 2012, Redbox and NCR Corporation (“NCR”) completed the transactions contemplated by

the Asset Purchase Agreement, dated as of February 3, 2012, as amended, by and between Redbox and

NCR (the “NCR Agreement”). Redbox acquired certain assets related to NCR’s self-service

entertainment DVD kiosk business (the “NCR Asset Acquisition”). The purchased assets include,

among others, self-service DVD kiosks, content inventory, intellectual property, and certain related

contracts, including with certain retailers. In consideration, Redbox paid NCR $100.0 million in cash

and assumed certain liabilities of NCR related to the purchased assets. In connection with the NCR

Asset Acquisition, Coinstar and NCR entered into a manufacturing and services agreement, pursuant to

which Coinstar, Redbox or an affiliate will purchase goods and services from NCR for a period of five

years from June 22, 2012. At the end of the five-year period, if the aggregate amount paid in margin to

NCR for goods and services delivered equals less than $25.0 million, Coinstar will pay NCR the

difference between such aggregate amount and $25.0 million. In addition, Redbox and NCR entered

into a transition services agreement, pursuant to which Redbox and NCR are providing certain

transition services to one another relating to the operation of the purchased DVD kiosks for a period of

one year from the agreement date. We accounted for the NCR Asset Acquisition as a business

combination. Costs related to the NCR Asset Acquisition and operating results of NCR’s self-service

entertainment DVD kiosk business are included in our Redbox segment results.

• On June 5, 2012, we announced an exclusive five-year agreement to roll out our Rubi coffee kiosks in

the grocery, drug and mass merchant retail channels featuring Seattle’s Best Coffee®beverages. We

expect this rollout to accelerate in 2013. The results of Rubi are included in our New Ventures

segment.

• In February 2012, Redbox and Verizon Ventures IV LLC (“Verizon”), a wholly owned subsidiary of

Verizon Communications Inc., entered into a Limited Liability Company Agreement (the “LLC

Agreement”) and related arrangements. The LLC Agreement governs the relationship of the parties

with respect to a joint venture, Redbox Instant by Verizon (the “Joint Venture”) formed for the primary

purpose of developing, launching, marketing and operating a nationwide “over-the-top” video

distribution service to provide consumers with access to video programming content, including linear

content, delivered via broadband networks to video enabled viewing devices and offering rental of

physical DVDs and Blu-ray Discs from Redbox kiosks. Redbox initially acquired a 35.0% ownership

interest in the Joint Venture and made an initial capital contribution of $14.0 million in cash in

February 2012 subsequent to the formation of the Joint Venture. The Joint Venture board of managers

may request each member to make additional capital contributions, on a pro rata basis relative to its

respective ownership interest. If a member does not make any or all of its requested capital

contributions, as the case may be, the other contributing member generally may make such capital

contributions. So long as Redbox contributes its pro rata share of the first $450.0 million of capital

contributions to the Joint Venture, Redbox’s interest cannot be diluted below 10.0%. During the third

quarter of 2012, at the request of the Joint Venture board of managers, Redbox made a cash payment of

$10.5 million representing its pro-rata share of the requested capital contribution. In addition, Redbox

has certain rights to cause Verizon to acquire Redbox’s interest in the Joint Venture at fair value

(generally following the fifth anniversary of the LLC Agreement or in limited circumstances, at an

earlier period of time) and Verizon has certain rights to acquire Redbox’s interest in the Joint Venture

at fair value (generally following the seventh anniversary of the LLC Agreement, or, in limited

circumstances, the fifth anniversary of the LLC Agreement). Redbox’s ownership interest in the Joint

Venture is accounted for using the equity method of accounting. See Note 5: Equity Method

Investments and Related Party Transactions in our Notes to Consolidated Financial Statements for

additional details.

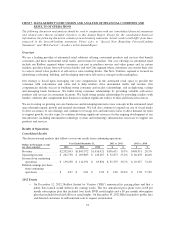

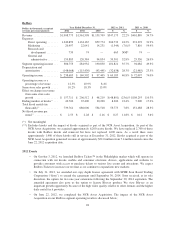

Comparing 2012 to 2011

Revenue increased $356.7 million, or 19.3%, primarily due to same store sales growth and new kiosk

installations in our Redbox segment as well as new kiosk installations and an increased number of transactions

and average transaction size in our Coin segment.

24