Redbox 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

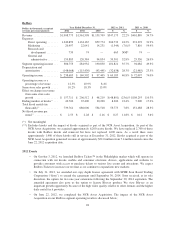

Redbox

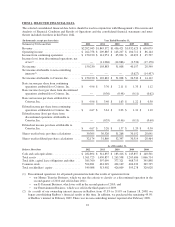

Dollars in thousands, except net

revenue per rental amounts

Year Ended December 31, 2012 vs. 2011 2011 vs. 2010

2012 2011 2010 $ % $ %

Revenue ................. $1,908,773 $1,561,598 $1,159,709 $347,175 22.2% $401,889 34.7%

Expenses:

Direct operating ....... 1,340,899 1,134,167 859,774 206,732 18.2% 274,393 31.9%

Marketing ............ 20,497 22,041 14,231 (1,544) (7.0)% 7,810 54.9%

Research and

development ........ 739 74 — 665 NM* 74 —

General and

administrative ....... 159,885 120,384 94,854 39,501 32.8% 25,530 26.9%

Segment operating income . . . 386,753 284,932 190,850 101,821 35.7% 94,082 49.3%

Depreciation and

amortization ............ (148,068) (115,430) (93,445) (32,638) 28.3% (21,985) 23.5%

Operating income .......... $ 238,685 $ 169,502 $ 97,405 $ 69,183 40.8% $ 72,097 74.0%

Operating income as a

percentage of revenue .... 12.5% 10.9% 8.4%

Same store sales growth ..... 10.2% 18.3% 13.0%

Effect on change in revenue

from same store sales

growth ................ $ 157,711 $ 206,512 $ 98,219 $ (48,801) (23.6)% $108,293 110.3%

Ending number of kiosks** . . . 43,700 35,400 30,200 8,300 23.4% 5,200 17.2%

Total kiosk rentals (in

thousands)** ............ 739,761 686,006 534,518 53,775 7.8% 151,488 28.3%

Net kiosk revenue per

rental** ................ $ 2.55 $ 2.28 $ 2.16 $ 0.27 11.8% $ 0.12 5.6%

(*) Not meaningful

(**) Excludes kiosks and the impact of kiosks acquired as part of the NCR Asset Acquisition. As part of the

NCR Asset Acquisition, we acquired approximately 6,200 active kiosks. We have replaced 2,700 of these

kiosks with Redbox kiosks and removed but have not replaced 1,600 more. As a result there were

approximately 1,900 of these kiosks still in service at December 31, 2012. Kiosks acquired as part of the

NCR Asset Acquisition generated revenue of approximately $22.0 million from 7.4 million rentals since the

June 22, 2012 acquisition date.

2012 Events

• On October 3, 2012, we launched Redbox TicketsTM in the Philadelphia market which will operate in

connection with our kiosks, mobile and consumer electronic devices, applications and websites to

provide customers with access to purchase tickets to various live events and attractions. We expect

Redbox Tickets to increase our revenue as we continue to expand into new markets;

• On July 31, 2012, we amended our copy depth license agreement with SPHE Scan Based Trading

Corporation (“Sony”) to extend the agreement until September 30, 2014. Sony received, at its sole

discretion, the option for two one-year extensions following the September 30, 2014 expiration. The

amended agreement also gave us the option to license Blu-ray product. We view Blu-ray as an

important growth opportunity because of the high video quality relative to other formats and the higher

daily rental fee it provides;

• On June 22, 2012, we completed the NCR Asset Acquisition. The impact of the NCR Asset

Acquisition on our Redbox segment operating results is discussed below;

28