Redbox 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

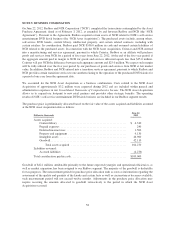

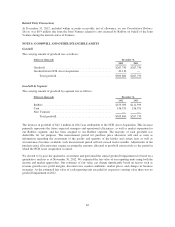

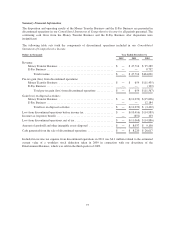

The following repurchases were made during the past three years, dollars in thousands except per share price:

Year Ended December 31,

# of shares

Repurchased

Average

Price

per Share

Total

Purchase

Price

2010 ....................................... 1,072,037 $45.94 $ 49,245

2011 ....................................... 1,374,036 46.10 63,349

2012 ....................................... 2,799,115 49.92 139,724

Total .................................. 5,245,188 $252,318

Repurchased shares become a part of treasury stock. The shares tendered for tax withholding on vesting of

restricted stock awards are excluded from the repurchase program approved by our Board.

Board Authorization

On January 31, 2013, our Board of Directors approved an additional repurchase program of up to $250.0 million

of our common stock plus the cash proceeds received from the exercise of stock options by our officers,

directors, and employees.

Credit Facility Requirements

Under our Credit Facility, we are permitted to repurchase shares of our common stock without limitation,

provided that we are in compliance with certain covenants required under the terms of the Credit Facility. See

Note 8: Debt and Other Long-Term Liabilities for additional information about the terms of the Credit Facility.

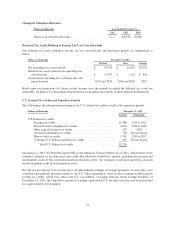

ASR Agreement

On November 1, 2012 we entered into an ASR Agreement with Morgan Stanley & Co at a notional amount of

$75.0 million. The ASR Agreement was concluded on December 28, 2012. The total number of shares received

under the ASR Agreement was determined based on the arithmetic mean of the daily volume weighted average

price of our common stock minus discount over the term of the ASR Agreement.

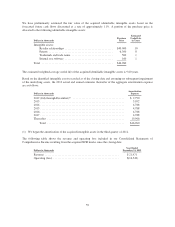

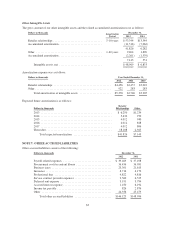

Share repurchase and amounts in thousands

Shares

Delivered

Total Shares delivered from ASR program ............................... 1,539

Average price per share less discount ................................... $ 48.74

Total Repurchase amount from ASR program ............................ $75,000

As the ASR Agreement was concluded, the total shares received were recorded as treasury shares, resulting in a

reduction of shares for our earnings per share calculations.

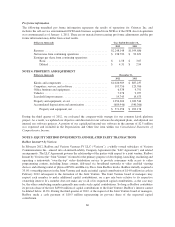

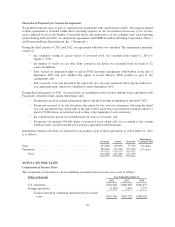

NOTE 10: SHARE-BASED PAYMENTS

We currently grant share-based awards to our employees, non-employee directors and consultants under our 2011

Incentive Plan (the “Plan”). The Plan permit the granting of stock options, restricted stock, restricted stock units,

and performance-based restricted stock.

The following is the summary of grant information:

Shares in thousands

December 31,

2012

Unissued common stock reserved for issuance under all plans ..... 2,282

Shares available for future grants ............................ 1,613

67