Red Lobster 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

›

Darden Restaurants, Inc.

64

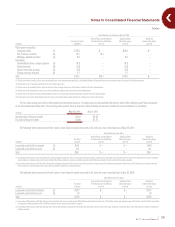

The following is a detail of the balance sheet components of each of our plans and a reconciliation of the amounts included in accumulated other comprehensive

income (loss):

Defined Benefit Plans Postretirement Benefit Plan

(in millions)

May 29, 2011 May 30, 2010 May 29, 2011 May 30, 2010

Components of the Consolidated Balance Sheets:

Current liabilities $ 0.4 $ 0.4 $ 0.7 $ 1.0

Non-current liabilities 28.0 45.2 26.3 37.9

Net amounts recognized $ 28.4 $ 45.6 $ 27.0 $ 38.9

Amounts Recognized in Accumulated Other Comprehensive

Income (Loss), net of tax:

Prior service (cost) credit $ (0.3) $ (0.3) $ 0.1 $ 0.1

Net actuarial loss (50.5) (55.3) (1.3) (11.2)

Net amounts recognized $ (5 0.8) $ (55.6) $ (1.2) $ (11.1)

The following is a summary of our accumulated and projected benefit obligations:

(in millions)

May 29, 2011 May 30, 2010

Accumulated benefit obligation for all pension plans $ 211.8 $ 196.7

Pension plans with accumulated benefit obligations in excess of plan assets:

Accumulated benefit obligation $ 211.8 $ 196.7

Fair value of plan assets $ 187.4 $ 154.6

Projected benefit obligations for all plans with projected benefit obligations in excess of plan assets $ 2 15.8 $ 200.2

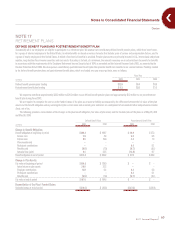

The following table presents the weighted-average assumptions used to determine benefit obligations and net expense:

Defined Benefit Plans Postretirement Benefit Plan

2011 2010 2011 2010

Weighted-average assumptions used to determine

benefit obligations at May 29 and May 30(1)

Discount rate 5.37% 5.89% 5.46% 5.98%

Rate of future compensation increases 3.75% 3.75% N/A N/A

Weighted-average assumptions used to determine

net expense for fiscal years ended May 29 and May 30(2)

Discount rate 5.89% 7.00% 5.98% 7.09%

Expected long-term rate of return on plan assets 9.00% 9.00% N/A N/A

Rate of future compensation increases 3.75% 3.75% N/A N/A

(1) Determined as of the end of fiscal year.

(2) Determined as of the beginning of fiscal year.