Red Lobster 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

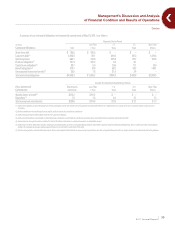

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

›

Darden Restaurants, Inc.

36

Our fixed-charge coverage ratio, which measures the number of times each

year that we earn enough to cover our fixed charges, amounted to 5.4 times and

4.7 times, on a continuing operations basis, for the fiscal years ended May 29,

2011 and May 30, 2010, respectively. Our adjusted debt to adjusted total capital

ratio (which includes 6.25 times the total annual minimum rent of $125.6 million

and $120.8 million for the fiscal years ended May 29, 2011 and May 30, 2010,

respectively, as components of adjusted debt and adjusted total capital) was

56 percent and 57 percent at May 29, 2011 and May 30, 2010, respectively. We

include the lease-debt equivalent and contractual lease guarantees in our adjusted

debt to adjusted total capital ratio reported to shareholders, as we believe its

inclusion better represents the optimal capital structure that we target from

period to period and because it is consistent with the calculation of the covenant

under our Revolving Credit Agreement.

Based on these ratios, we believe our financial condition is strong. The

composition of our capital structure is shown in the following table.

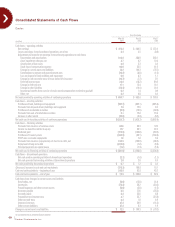

May 29, May 30,

(in millions, except ratios)

2011 2010

Capital Structure

Short-term debt $ 185.5 $ —

Current portion long-term debt — 225.0

Long-term debt, excluding unamortized discounts 1,4 11.7 1,413.6

Capital lease obligations 57.3 58.9

Total debt $ 1,654.5 $ 1,697.5

Stockholders’ equity 1,936.2 1,894.0

Total capital $ 3,590.7 $ 3,5 91.5

Calculation of Adjusted Capital

Total debt $ 1,654.5 $ 1,697.5

Lease-debt equivalent 785.0 755.0

Guarantees 7.4 9.0

Adjusted debt $ 2,446.9 $ 2,461.5

Stockholders’ equity 1,936.2 1,894.0

Adjusted total capital $ 4,383.1 $ 4,3 5 5.5

Capital Structure Ratios

Debt to total capital ratio 46% 47%

Adjusted debt to adjusted total capital ratio 56% 57%

Net cash flows provided by operating activities from continuing operations

were $894.7 million, $903.4 million and $783.5 million in fiscal 2011, 2010 and

2009, respectively. Net cash flows provided by operating activities include net

earnings from continuing operations of $478.7 million, $407.0 million and

$371.8 million in fiscal 2011, 2010 and 2009, respectively. Net cash flows provided

by operating activities from continuing operations decreased in fiscal 2011

primarily due to the impact of the timing of inventory purchases and overall

product demand, and higher income tax payments during fiscal 2011, partially

offset by an increase in net earnings. Net cash flows provided by operating

activities reflect income tax payments of $126.4 million, $94.8 million and

$64.4 million in fiscal 2011, 2010 and 2009, respectively. The lower tax payments

in fiscal 2009, as compared with tax payments in fiscal 2011 and 2010, primarily

relates to the recognition of tax benefits related to the timing of deductions for

fixed-asset related expenditures. In addition, the lower tax payments in fiscal

2009 and 2010, relates to the application of the overpayment of income taxes

in prior years to fiscal 2009 and 2010 tax liabilities.

Net cash flows used in investing activities from continuing operations were

$552.7 million, $428.7 million and $562.4 million in fiscal 2011, 2010 and 2009,

respectively. Net cash flows used in investing activities from continuing operations

included capital expenditures incurred principally for building new restaurants,

replacing equipment, our new restaurant support center facility and technology

initiatives. Capital expenditures related to continuing operations were $547.7 million

in fiscal 2011, compared to $432.1 million in fiscal 2010 and $535.3 million in fiscal

2009. The increased expenditures in fiscal 2011 resulted primarily from an increase

in remodel activity and new restaurant construction. The decreased expenditures

in fiscal 2010 resulted primarily from decreased spending associated with our new

restaurant support center facility which was completed in the second quarter of

fiscal 2010, and the replacement of restaurant assets. We estimate that our fiscal

2012 capital expenditures will be approximately $600 million.

Net cash flows used in financing activities from continuing operations were

$521.0 million, $290.0 million and $204.8 million in fiscal 2011, 2010 and 2009,

respectively. Cash flows used in financing activities for fiscal 2011 exceeded cash

flows used in financing activities for fiscal 2010, due primarily to an increase in

shares repurchased, the repayment of $226.8 million of long-term debt as compared

to $1.8 million in fiscal 2010 and an increase in dividends paid, partially offset by

proceeds from the issuance of short-term debt of $185.0 million in fiscal 2011, as

compared to repayments of short-term debt of $150.0 million during fiscal 2010.

Cash flows used in financing activities for fiscal 2010 exceeded the cash flows used

in financing activities for fiscal 2009 due primarily to the repayment of short-term

debt in fiscal 2010 in excess of the repayments during fiscal 2009 and an increase

in dividends paid, partially offset by a reduction in shares repurchased in fiscal

2010. For fiscal 2011, net cash flows used in financing activities included our

repurchase of 8.6 million shares of our common stock for $385.5 million, compared

to 2.0 million shares of our common stock for $85.1 million in fiscal 2010 and

5.1 million shares of our common stock for $144.9 million in fiscal 2009. As of

May 29, 2011, our Board of Directors had authorized us to repurchase up to 187.4

million shares of our common stock and a total of 162.7 million shares had been

repurchased under the authorization. The repurchased common stock is reflected

as a reduction of stockholders’ equity. As of May 29, 2011, our unused authoriza-

tion was 24.7 million shares. We received proceeds primarily from the issuance of

common stock upon the exercise of stock options of $63.0 million, $66.3 million

and $57.5 million in fiscal 2011, 2010 and 2009, respectively. Net cash flows used

in financing activities also included dividends paid to stockholders of $175.5 million,

$140.0 million and $110.2 million in fiscal 2011, 2010 and 2009, respectively. The

increase in dividend payments reflects the increase in our annual dividend rate

from $0.80 per share in fiscal 2009, to $1.00 per share in fiscal 2010 and to

$1.28 per share in fiscal 2011. In June 2011, our Board of Directors approved an

increase in the quarterly dividend to $0.43 per share, which indicates an annual

dividend of $1.72 per share in fiscal 2012.