Red Lobster 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

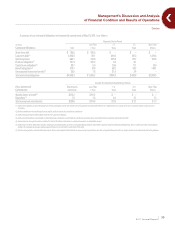

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

›

Darden Restaurants, Inc.

38

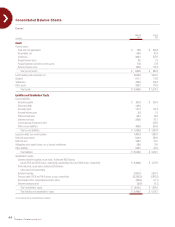

Our total current liabilities were $1.29 billion at May 29, 2011, compared

with $1.21 billion at May 30, 2010. Short-term debt increased $185.5 million,

primarily due to our use of short-term financing to repurchase shares of our

common stock. Other current liabilities increased $68.4 million, primarily as

a result of market-driven increases in fair value of our non-qualified deferred

compensation plan. Unearned revenues increased $27.3 million associated

with an increase in gift card sales, only partially offset by redemptions. These

increases were partially offset by the decrease in current portion of long-term

debt due to the repayment of our $150.0 million August 2010 senior notes and

our $75.0 million April 2011 medium-term notes.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations in interest

rates, foreign currency exchange rates, compensation and commodity prices.

To manage this exposure, we periodically enter into interest rate and foreign

currency exchange instruments, equity forwards and commodity instruments

for other than trading purposes (see Notes 1 and 10 to our consolidated

financial statements, in Part II, Item 8 of this report, incorporated herein

by reference).

We use the variance/covariance method to measure value at risk, over time

horizons ranging from one week to one year, at the 95 percent confidence level.

At May 29, 2011, our potential losses in future net earnings resulting from changes

in foreign currency exchange rate instruments, commodity instruments, equity

forwards and floating rate debt interest rate exposures were approximately

$53.6 million over a period of one year (including the impact of the interest rate

swap agreements discussed in Note 10 to our consolidated financial statements

in Part II, Item 8 of this report, incorporated herein by reference). The value at

risk from an increase in the fair value of all of our long-term fixed rate debt,

over a period of one year, was approximately $117.4 million. The fair value of our

long-term fixed rate debt during fiscal 2011 averaged $1.61 billion, with a high

of $1.77 billion and a low of $1.51 billion. Our interest rate risk management

objective is to limit the impact of interest rate changes on earnings and cash

flows by targeting an appropriate mix of variable and fixed rate debt.

APPLICATION OF NEW ACCOUNTING STANDARDS

In January 2010, the FASB issued Accounting Standards Update (ASU) 2010-06,

Fair Value Measurements and Disclosures (Topic 820), Improving Disclosures

about Fair Value Measurements, which required additional disclosure of significant

transfers in and out of instruments categorized as Level 1 and 2 in the Fair Value

hierarchy. This update also clarified existing disclosure requirements by defining

the level of disaggregation of instruments into classes as well as additional

disclosure around the valuation techniques and inputs used to measure fair value.

Additionally, for instruments categorized as Level 3 in the Fair Value hierarchy,

the guidance required a roll forward of activities on purchases, sales, issuance,

and settlements of the assets and liabilities. This update became effective for us

in the fourth quarter of fiscal 2010 except for the disclosure on the roll forward

of activities for Level 3 fair value measurements, which will become effective for

us in the first quarter of fiscal 2012. Other than requiring additional disclosures,

adoption of this new guidance will not have a significant impact on our consolidated

financial statements.

In May 2011, the FASB issued ASU No. 2011-04, Fair Value Measurement

(Topic 820), Amendments to Achieve Common Fair Value Measurement and

Disclosure Requirements in U.S. GAAP and IFRS. Many of the amendments in

this update change the wording used in the existing guidance to better align U.S.

generally accepted accounting principles with International Financial Reporting

Standards and to clarify the FASB’s intent on various aspects of the fair value

guidance. This update also requires increased disclosure of quantitative information

about unobservable inputs used in a fair value measurement that is categorized

within Level 3 of the fair value hierarchy. This update is effective for us in our

first quarter of fiscal 2013 and should be applied prospectively. Other than requiring

additional disclosures, adoption of this new guidance will not have a significant

impact on our consolidated financial statements.

In June 2011, the FASB issued ASU No. 2011-05, Comprehensive Income

(Topic 220), Presentation of Comprehensive Income, which requires companies

to present the total of comprehensive income, the components of net income,

and the components of other comprehensive income either in a single continuous

statement of comprehensive income or in two separate but consecutive statements.

This update eliminates the option to present the components of other compre-

hensive income as part of the statement of equity. This update is effective for

us in our first quarter of fiscal 2013 and should be applied retrospectively. We

do not believe adoption of this new guidance will have a significant impact on

our consolidated financial statements.

FORWARD-LOOKING STATEMENTS

Statements set forth in or incorporated into this report regarding the expected

net increase in the number of our restaurants, U.S. same-restaurant sales, total

sales growth, diluted net earnings per share growth, and capital expenditures in

fiscal 2011, and all other statements that are not historical facts, including without

limitation statements with respect to the financial condition, results of operations,

plans, objectives, future performance and business of Darden Restaurants, Inc.

and its subsidiaries that are preceded by, followed by or that include words such

as “may,” “will,” “expect,” “intend,” “anticipate,” “continue,” “estimate,” “project,”

“believe,” “plan” or similar expressions, are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995 and are

included, along with this statement, for purposes of complying with the safe

harbor provisions of that Act. Any forward-looking statements speak only as of

the date on which such statements are made, and we undertake no obligation to

update such statements for any reason to reflect events or circumstances arising

after such date. By their nature, forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially from those set

forth in or implied by such forward-looking statements. In addition to the risks

and uncertainties of ordinary business obligations, and those described in infor-

mation incorporated into this report, the forward-looking statements contained

in this report are subject to the risks and uncertainties described in Part I, Item

1A “Risk Factors” in our Annual Report on Form 10-K for the year ended May 29,

2011, which are summarized as follows:

•Foodsafetyandfood-borneillnessconcernsthroughoutthesupplychain;

•Litigation,includingallegationsofillegal,unfairorinconsistentemployment

practices, by employees, guests, suppliers, shareholders or others, regard-

less of whether the allegations made against us are valid or we are

ultimatelyfoundliable;