Red Lobster 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

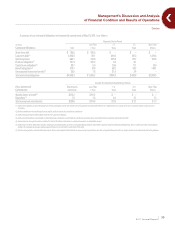

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

›

Darden Restaurants, Inc.

28

Olive Garden’s sales of $3.32 billion in fiscal 2010 were 1.0 percent above

fiscal 2009. Olive Garden opened 32 net new restaurants during fiscal 2010. On

a 52-week basis, annual U.S. same-restaurant sales for Olive Garden decreased

1.0 percent due to a 3.0 percent decrease in same-restaurant guest counts

partially offset by a 2.0 percent increase in average guest check. Average annual

sales per restaurant for Olive Garden were $4.7 million in fiscal 2010 compared

to $4.8 million in fiscal 2009 (52-week basis).

Red Lobster’s sales of $2.49 billion in fiscal 2010 were 5.3 percent below

fiscal 2009. Red Lobster opened four net new restaurants during fiscal 2010. On

a 52-week basis, annual U.S. same-restaurant sales for Red Lobster decreased

4.9 percent due to a 6.3 percent decrease in same-restaurant guest counts,

partially offset by a 1.4 percent increase in average guest check. Average annual

sales per restaurant for Red Lobster were $3.6 million in fiscal 2010 compared to

$3.8 million in fiscal 2009 (52-week basis).

LongHorn Steakhouse’s sales of $881.8 million in fiscal 2010 were 0.7 percent

below fiscal 2009. LongHorn Steakhouse opened 10 net new restaurants during

fiscal 2010. On a 52-week basis, annual same-restaurant sales for LongHorn

Steakhouse decreased 1.9 percent due to a 4.2 percent decrease in same-

restaurant guest counts, partially offset by a 2.3 percent increase in average

guest check. Average annual sales per restaurant for LongHorn Steakhouse were

$2.7 million in fiscal 2010 compared to $2.8 million in fiscal 2009 (52-week basis).

In total, our remaining brands generated sales of $422.0 million in fiscal

2010, which were 3.2 percent above fiscal 2009, primarily driven by three new

restaurants at The Capital Grille, one new restaurant at Bahama Breeze and

three new restaurants at Seasons 52. Additionally, sales growth reflected same-

restaurant sales decreases of 7.8 percent at The Capital Grille, 2.9 percent at

Bahama Breeze and 0.5 percent at Seasons 52. Average annual sales per

restaurant for The Capital Grille were $6.2 million in fiscal 2010 compared to

$6.8 million in fiscal 2009 (52-week basis). Average annual sales per restaurant

for Bahama Breeze were $5.4 million in fiscal 2010 compared to $5.5 million in

fiscal 2009 (52-week basis). Average annual sales per restaurant for Seasons 52

were $5.9 million in fiscal 2010 and fiscal 2009 (52-week basis).

COSTS AND EXPENSES

Total costs and expenses from continuing operations were $6.85 billion in fiscal

2011, $6.57 billion in fiscal 2010 and $6.70 billion in fiscal 2009. As a percent of

sales, total costs and expenses from continuing operations in fiscal 2011 were

91.4 percent, which decreased from 92.4 percent in fiscal 2010 and 92.9 percent

in fiscal 2009.

Food and beverage costs increased $122.4 million, or 6.0 percent, from

$2.05 billion in fiscal 2010 to $2.17 billion in fiscal 2011. Food and beverage costs

decreased $149.1 million, or 6.8 percent, from $2.20 billion in fiscal 2009 to

$2.05 billion in fiscal 2010. As a percent of sales, food and beverage costs increased

from fiscal 2010 to fiscal 2011 primarily as a result of higher seafood and other

commodity costs, partially offset by pricing. As a percent of sales, food and

beverage costs decreased from fiscal 2009 to fiscal 2010 primarily as a result

of lower seafood, beef and commodity costs and pricing.

Restaurant labor costs increased $46.3 million, or 2.0 percent, from

$2.35 billion in fiscal 2010 to $2.40 billion in fiscal 2011. Restaurant labor costs

increased $42.4 million, or 1.8 percent, from $2.31 billion in fiscal 2009 to

$2.35 billion in fiscal 2010. As a percent of sales, restaurant labor costs decreased

in fiscal 2011 primarily as a result of pricing, increased employee productivity,

lower manager incentive compensation, decreased employee insurance claims

costs and improved wage-rate management, partially offset by higher unemploy-

ment taxes. As a percent of sales, restaurant labor costs increased in fiscal 2010

primarily as a result of an increase in wage rates, manager compensation, employee

medical costs and the impact of sales deleveraging partially offset by productivity

gains and reduced turnover.

Restaurant expenses (which include utilities, repairs and maintenance, lease,

credit card, property tax, workers’ compensation, new restaurant pre-opening and

other restaurant-level operating expenses) increased $46.8 million, or 4.3 percent,

from $1.08 billion in fiscal 2010 to $1.13 billion in fiscal 2011. Restaurant expenses

decreased $46.2 million, or 4.1 percent, from $1.13 billion in fiscal 2009 to

$1.08 billion in fiscal 2010. As a percent of sales, restaurant expenses decreased

in fiscal 2011 as compared to fiscal 2010 primarily due to pricing and lower general

liability expenses partially offset by higher credit card fees. As a percent of sales,

restaurant expenses decreased in fiscal 2010 as compared to fiscal 2009 primarily

as a result of lower utility costs and repair and maintenance expenses, which

were partially offset by the impact of sales deleveraging.

Selling, general and administrative expenses increased $53.5 million, or

7.8 percent, from $684.5 million in fiscal 2010 to $738.0 million in fiscal 2011. Selling,

general and administrative expenses increased $18.9 million, or 2.8 percent, from

$665.6 million in fiscal 2009 to $684.5 million in fiscal 2010. As a percent of sales,

selling, general and administrative expenses increased from fiscal 2010 to fiscal

2011 primarily due to higher media expenses and compensation expenses partially

offset by sales leveraging. As a percent of sales, selling, general and administrative

expenses increased from fiscal 2009 to fiscal 2010 primarily as a result of unfavor-

able market-driven changes in fair value related to our non-qualified deferred

compensation plans, as well as an increase in advertising expenses, performance

incentive compensation and the impact of sales deleveraging.

Depreciation and amortization expense increased $15.9 million, or 5.3 percent,

from $300.9 million in fiscal 2010 to $316.8 million in fiscal 2011. Depreciation and

amortization expense increased $17.8 million, or 6.3 percent, from $283.1 million in

fiscal 2009 to $300.9 million in fiscal 2010. As a percent of sales, depreciation and

amortization expense decreased in fiscal 2011 primarily due to sales leveraging,

partially offset by the increase in depreciable assets related to new restaurants

and remodel activities. As a percent of sales, depreciation and amortization

expense increased in fiscal 2010 as a result of new restaurant openings, the

incremental depreciation associated with the new restaurant support center facility

and sales deleveraging.

Net interest expense decreased $0.3 million, or 0.3 percent, from $93.9 million

in fiscal 2010 to $93.6 million in fiscal 2011. Net interest expense decreased

$13.5 million, or 12.6 percent, from $107.4 million in fiscal 2009 to $93.9 million in

fiscal 2010. As a percent of sales, net interest expense decreased in fiscal 2011

compared to fiscal 2010 primarily as a result of lower average debt balances

associated with the repayment of a portion of our long-term debt and sales

leveraging, partially offset by the fiscal 2010 release of interest reserves associated

with the favorable resolution of tax matters in fiscal 2010. As a percent of sales,

net interest expense decreased in fiscal 2010 compared to fiscal 2009 primarily

as a result of lower average debt balances associated with the repayment of all

our short-term debt and the release of interest reserves associated with the

favorable resolution in the current year of prior year tax matters.