Red Lobster 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

›

2011 Annual Report 57

initially designated as cash flow hedges to the extent the Darden stock units are

unvested and, therefore, unrecognized as a liability in our financial statements. As of

May 29, 2011, we were party to equity forward contracts that were indexed to 0.9 mil-

lion shares of our common stock, at varying forward rates between $27.57 per share

and $42.08 per share, extending through August 2015. The forward contracts can

only be net settled in cash. As the Darden stock units vest, we will de-designate that

portion of the equity forward contract that no longer qualifies for hedge accounting

and changes in fair value associated with that portion of the equity forward contract

will be recognized in current earnings. We periodically incur interest on the notional

value of the contracts and receive dividends on the underlying shares. These amounts

are recognized currently in earnings as they are incurred.

We entered into equity forward contracts to hedge the risk of changes in

future cash flows associated with recognized, cash-settled performance stock

units and employee-directed investments in Darden stock within the non-qualified

deferred compensation plan. The equity forward contracts are indexed to 0.2 million

shares of our common stock at forward rates between $23.41 and $50.19 per

share, can only be net settled in cash and expire between fiscal 2012 and 2016.

We did not elect hedge accounting with the expectation that changes in the fair

value of the equity forward contracts would offset changes in the fair value of

the performance stock units and Darden stock investments in the non-qualified

deferred compensation plan within selling, general and administrative expenses

in our consolidated statements of earnings.

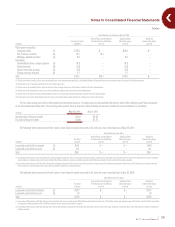

The fair value of our derivative contracts designated as hedging instruments and derivative contracts that are not designated as hedging instruments are as follows:

Balance Derivative Assets Derivative Liabilities

Sheet

(in millions)

Location May 29, 2011 May 30, 2010 May 29, 2011 May 30, 2010

Derivative contracts designated as hedging instruments

Commodity contracts (1) $ 0.1 $ — $ — $ (0.6)

Equity forwards (1) 0.4—— (0.4)

Interest rate related (1) 3.6 3.4 (23.2) (10.5)

Foreign currency forwards (1) 0.6 1.1 — —

$ 4.7 $ 4.5 $ (23.2) $ (11.5)

Derivative contracts not designated as hedging instruments

Commodity contracts (1) $ 0.6 $ — $ — $ —

Equity forwards (1) 0.5—— (0.6)

$ 1.1 $ — $ — $ (0.6)

Total derivative contracts $ 5.8 $ 4.5 $ (23.2) $ (12.1)

(1) Derivative assets and liabilities are included in Receivables, net, Prepaid expenses and other current assets, and Other current liabilities, as applicable, on our consolidated balance sheets.

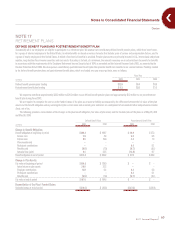

The effects of derivative instruments in cash flow hedging relationships on the consolidated statements of earnings are as follows:

(1)

Amount of Gain (Loss) Location of Gain (Loss) Amount of Gain (Loss) Location of Gain (Loss) Amount of Gain (Loss)

Recognized in AOCI Reclassified from AOCI Reclassified from AOCI Recognized in Earnings Recognized in Earnings

(in millions)

(Effective Portion) to Earnings to Earnings (Effective Portion) (Ineffective Portion) (Ineffective Portion)

Fiscal Year Fiscal Year Fiscal Year

2011 2010 2009 2011 2010 2009 2011 2010 2009

Commodity $ (0.2) $(2.1) $ (8.7) (2) $(0.9) $(3.8) $(6.1) (2) $ — $ — $—

Equity 2.6 3.9 1.2 (3) — — — (3) 0.2 0.3 —

Interest rate (12.2) (7.7) (6.9) Interest, net 0.7 0.5 (1.3) Interest, net (0.5) — —

Foreign currency (0.1) 1.3 0.8 (4) 0.4 1.1 -- (4) — — —

$ (9.9) $(4.6) $(13.6) $ 0.2 $(2.2) $(7.4) $(0.3) $0.3 $—

(1) Generally, all of our derivative instruments designated as cash flow hedges have some level of ineffectiveness, which is recognized currently in earnings. However, as these amounts are generally nominal and our consolidated financial statements

are presented “in millions,” these amounts may appear as zero in this tabular presentation.

(2) Location of the gain (loss) reclassified from AOCI to earnings as well as the gain (loss) recognized in earnings for the ineffective portion of the hedge is food and beverage costs and restaurant expenses, which are components of cost of sales.

(3) Location of the gain (loss) reclassified from AOCI to earnings as well as the gain (loss) recognized in earnings for the ineffective portion of the hedge is restaurant labor expenses, which is a component of cost of sales, and selling, general and

administrative expenses.

(4) Location of the gain (loss) reclassified from AOCI to earnings as well as the gain (loss) recognized in earnings for the ineffective portion of the hedge is food and beverage costs, which is a component of cost of sales, and selling, general and

administrative expenses.