Red Lobster 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

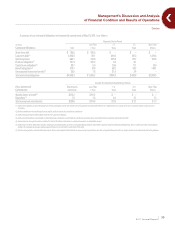

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

›

Darden Restaurants, Inc.

34

As of May 29, 2011, we had no outstanding balances under the Revolving

Credit Agreement. As of May 29, 2011, $185.5 million of commercial paper and

$68.2 million of letters of credit were outstanding, which are backed by this

facility. After consideration of borrowings currently outstanding and commercial

paper and letters of credit backed by the Revolving Credit Agreement, as of

May 29, 2011, we had $496.3 million of credit available under the Revolving

Credit Agreement.

At May 29, 2011, our long-term debt consisted principally of:

•$350.0millionofunsecured5.625percentseniornotesduein

October2012;

•$100.0millionofunsecured7.125percentdebenturesduein

February2016;

•$500.0millionofunsecured6.200percentseniornotesduein

October2017;

•$150.0millionofunsecured6.000percentseniornotesduein

August2035;

•$300.0millionofunsecured6.800percentseniornotesduein

October2037;and

•Anunsecured,variablerate$8.0millioncommercialbankloanduein

December 2018 that is used to support a loan from us to the Employee

Stock Ownership Plan (ESOP) portion of the Darden Savings Plan.

During fiscal 2011, we repaid, at maturity, our $150.0 million 4.875 percent

senior notes due August 2010 and our $75.0 million 7.450 percent medium-term notes

due April 2011 with excess cash from operations. During fiscal 2012, we expect to

issue unsecured debt securities that will effectively refinance these notes.

The interest rates on our $350.0 million senior notes due October 2012,

$500.0 million senior notes due October 2017 and $300.0 million senior notes due

October 2037 are subject to adjustment from time to time if the debt rating assigned

to such series of notes is downgraded below a certain rating level (or subsequently

upgraded). The maximum adjustment is 2.000 percent above the initial interest

rate and the interest rate cannot be reduced below the initial interest rate. As of

May 29, 2011, no adjustments to these interest rates had been made.

All of our long-term debt currently outstanding is expected to be repaid

entirely at maturity with interest being paid semi-annually over the life of the

debt. The aggregate maturities of long-term debt for each of the five fiscal years

subsequent to May 29, 2011 and thereafter are $0.0 million in fiscal 2012,

$350.0 million in fiscal 2013, $0.0 million in fiscal 2014, $0.0 million in fiscal

2015, $100.0 million in fiscal 2016 and $958.0 million thereafter.

From time to time we enter into interest rate derivative instruments to

manage interest rate risk inherent in our operations. See Note 10 to our

consolidated financial statements in Part II, Item 8 of this report, incorporated

herein by reference.

Through our shelf registration statement on file with the Securities and

Exchange Commission (SEC), depending on conditions prevailing in the public

capital markets, we may issue unsecured debt securities from time to time in

one or more series, which may consist of notes, debentures or other evidences

of indebtedness in one or more offerings.

We may from time to time repurchase our outstanding debt in privately

negotiated transactions. Such repurchases, if any, will depend on prevailing

market conditions, our liquidity requirements and other factors.