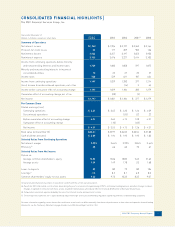

PNC Bank 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For us to act as a unified company on behalf of our customers, we must

change, and we have, as this report comes to you, begun the process of

making PNC leaner and more responsive. I am leading an aggressive efficiency

initiative with goals of maximizing revenue opportunities and finding ways to

cut costs. We have asked people at all levels across the organization to take a

hard look at how they operate, and we will implement the ideas our teams

generate during the balance of this year.

Second, we will claim the advantage of our size. Our industry has experienced

steady consolidation for many years, and with recent mergers we have seen

the advent of the trillion-dollar bank. In consolidation lies opportunity –

we compete against fewer banks for our core middle-market customers, for

example – and in our size lies possibility unavailable to the mega-banks.

We are big enough, we have enough resources, to compete for the business

we choose to pursue, but we are also small enough to be nimble and quick

to respond to our customers’ needs. A more efficient PNC will be a formidable

competitor against firms large and small.

Third, we will continue to manage our balance sheet with a focus on creating

long-term value. We have developed a highly sophisticated set of tools –

including an index against which we can measure our performance and daily

balance sheet valuation reporting – that allows us to make fast, well informed,

risk-appropriate investment decisions.

Fourth, we will understand our customers and prospects better. We have

developed a very robust database of information that delivers knowledge about

our customers to the fingertips of our employees sitting alongside those

customers. In 2005, we will further this competency by completing a rigorous

program aimed at identifying our market opportunities across products and

regions.

Finally, we will continue to innovate and invest. Over the past several years,

we have generated myriad new products, including the highly successful

BlackRock Solutions®and Treasury Management’s A/R Advantage, and we will

push our people to create further innovations in the years ahead. We will also

continue to invest in the profitable expansion of our existing businesses, and

we will continue to seek acquisitions in high-growth markets.

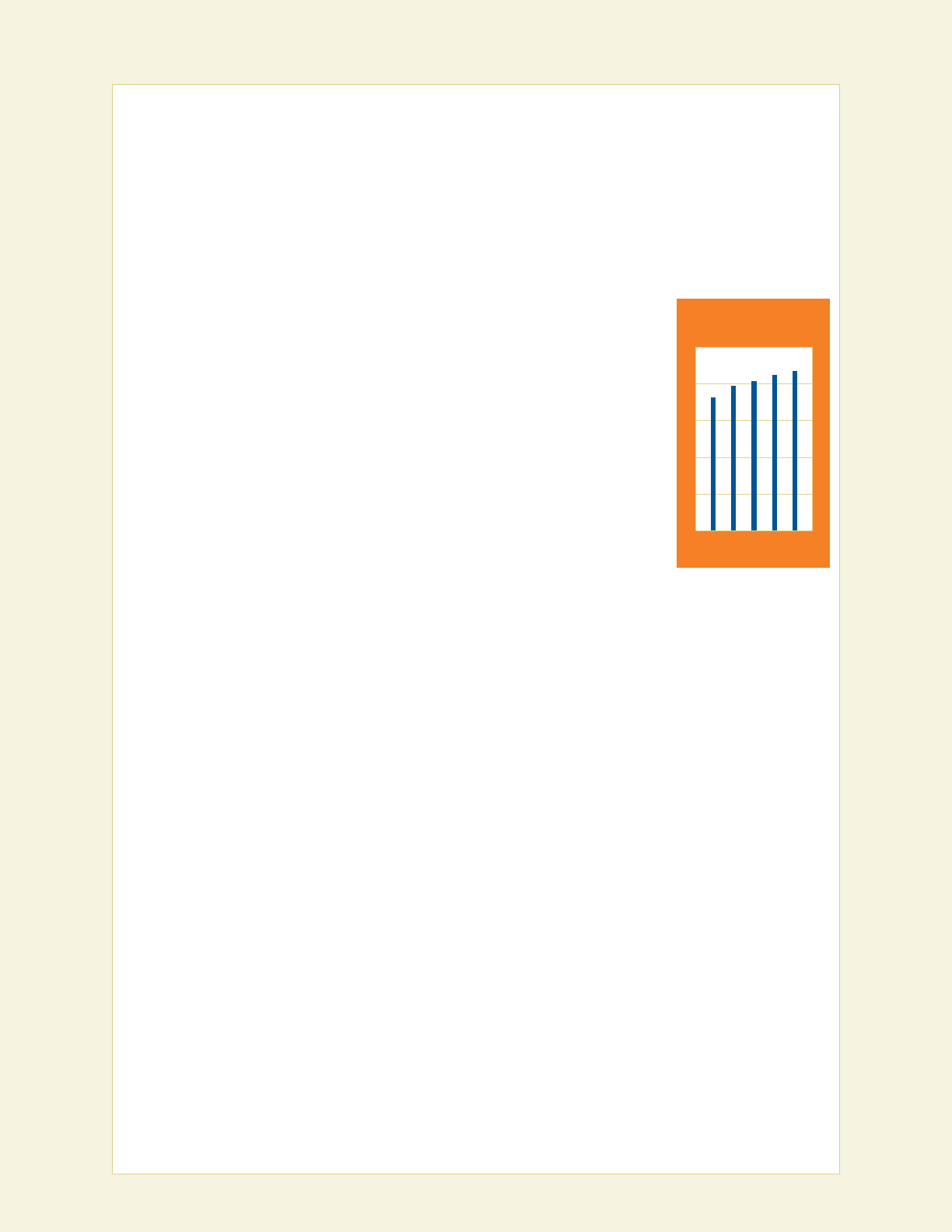

0

10

20

30

40

50

4Q

04

3Q

04

2Q

04

1Q

04

4Q

03

LOANS

$ billions

At quarter end