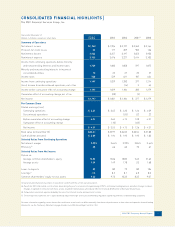

PNC Bank 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS}

I am pleased to report that your company had an

excellent year in 2004 and is well positioned to thrive

in the years ahead. We are driven by a vision of PNC

as an industry leader – devoted to best-in-class

customer service and delivering strong growth with

moderate risk – and we are focused on bringing this

vision to reality.

In 2004 we earned $1.2 billion, a 20 percent increase over 2003. We made

steady gains across customer segments, which led to a 14 percent increase

in average loans and a 12 percent increase in average deposits. Our total

assets grew to $80 billion, an increase of 17 percent over 2003. Asset quality

improved dramatically. And assets under management increased eight

percent, while total assets serviced increased 13 percent, to $1.8 trillion.

In addition to this earnings and balance sheet growth, we made substantial

capital investments to expand the franchise. We successfully integrated New

Jersey-based United National Bancorp early in 2004. In July, we announced

the still-pending acquisition of Riggs National Corporation, a move that will

give us entrée into the extremely lucrative Washington, D.C. metropolitan

marketplace. And in January 2005 BlackRock, our asset management

company, closed its acquisition of SSRM Holdings, Inc.; that transaction

pushed assets under management at BlackRock to almost $400 billion.

Prudent management of our balance sheet underpinned our growth in 2004.

For the past several years, I have emphasized in this space that PNC would

resist the temptation of undue interest rate risk, that we would forego

short-term profits to ensure that we could avoid the value-destroying impact

of interest rate volatility. In 2004, those commitments were rewarded: While

many of our competitors suffered from rising interest rates, we did not.

22004 PNC Summary Annual Report

0

10

20

30

40

50

60

70

80

90

04

03

02

ASSETS

$ billions

At December 31