PNC Bank 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

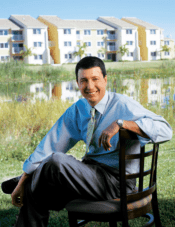

“Our PNC bankers came up with the best option

for us. They combined multiple financing

products to develop a creative solution to the

complex financing needs of our Villas del Lago

development in Miami. I know I can rely on

PNC for intelligent, efficient options for Royal

Castle’s future projects.”

– Elliot Stone, Principal, Royal Castle Companies

Delivering a unified PNC

PNC is an organization of more than 23,000 employees, with $80 billion in

assets and offices around the country and overseas. But we are committed to

delivering to each of our customers a unified approach that taps the full range

of our expertise. In practice, that means that when a consumer checking

customer seeks financing for a new business idea, we work to serve that need

seamlessly. When the CEO of a corporate client needs a wealth management

plan, PNC Advisors steps in to assist. And when a small business grows into

a middle market business, the customer experiences no disruption in service

from PNC.

Part of our ability to offer such comprehensive service comes from our clear

understanding of our customers. We have developed a robust database of

information so that our employees have access to the information they need

to serve our customers.

We intend to move even closer to our customers throughout the course

of 2005, as we undertake an initiative to become more efficient in our

service – to reduce corporate elements that do not contribute to our ability

to meet customer needs.

Overarching success at PFPC

PFPC, our mutual fund processing company,

achieved remarkable success in 2004. In a

market environment challenged by weak

equity trading volumes, investigations

into the mutual fund industry and fierce

competition that exerted downward

pressure on prices, PFPC nevertheless

produced nine percent earnings growth and

increased its total assets serviced to $1.8

trillion, a 13 percent increase over 2003.

Gains in offshore and alternative assets, as

well as disciplined cost control, contributed

to PFPC’s success.