PNC Bank 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

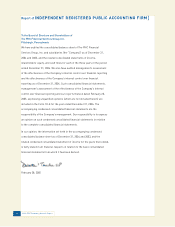

CAUTIONARY STATEMENT Regarding Forward-Looking Information}

The PNC Financial Services Group, Inc.

We make statements in this Summary Annual Report, and we may from time to

time make other statements, regarding our outlook or expectations for earnings,

revenues, expenses and/or other matters regarding or affecting PNC that are

forward-looking statements. Forward-looking statements are typically identified

by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and

uncertainties, which change over time. Forward-looking statements speak only

as of the date they are made. We do not assume any duty and do not undertake

to update our forward-looking statements. Actual results or future events

could differ, possibly materially, from those that we anticipated in our forward-

looking statements, and future results could differ materially from our historical

performance.

In addition to factors that we disclose in our 2004 Annual Report on Form 10-K

and other SEC reports (accessible on the SEC’s website at www.sec.gov and on

or through PNC’s corporate website at www.pnc.com) and those that we discuss

elsewhere in this document, PNC’s forward-looking statements are subject to,

among others, the following risks and uncertainties, which could cause actual

results or future events to differ materially from those that we anticipated in

our forward-looking statements or from our historical performance:

• Changes in political, economic or industry conditions, the interest rate environ-

ment or the financial and capital markets (including as a result of actions of

the Federal Reserve Board affecting interest rates, the money supply or other-

wise reflecting changes in monetary policy), which could affect: (a) credit quali-

ty and the extent of our credit losses; (b) the extent of funding of our unfunded

loan commitments and letters of credit; (c) our allowances for loan and lease

losses and unfunded loan commitments and letters of credit; (d) demand for

our credit or fee-based products and services; (e) our net interest income;

(f) the value of assets under management and assets serviced, of private

equity investments, of other debt and equity investments, of loans held for

sale, or of other on-balance sheet or off-balance sheet assets; or (g) the

availability and terms of funding necessary to meet our liquidity needs;

• The impact on us of legal and regulatory developments, including the following:

(a) the resolution of legal proceedings or regulatory and other governmental

inquiries; (b) increased litigation risk from recent regulatory and other govern-

mental developments; (c) the results of the regulatory examination process,

our failure to satisfy the requirements of agreements with governmental

agencies, and regulators’ future use of supervisory and enforcement tools;

(d) legislative and regulatory reforms, including changes to tax laws; and

(e) changes in accounting policies and principles, with the impact of any such

developments possibly affecting our ability to operate our businesses or our

financial condition or results of operations or our reputation, which in turn

could have an impact on such matters as business generation and retention,

our ability to attract and retain management, liquidity and funding;

• The impact on us of changes in the nature or extent of our competition;

• The introduction, withdrawal, success and timing of our business initiatives

and strategies;

• Customer acceptance of our products and services, and our customers’

borrowing, repayment, investment and deposit practices;

• The impact on us of changes in the extent of customer or counterparty

delinquencies, bankruptcies or defaults, which could affect, among other

things, credit and asset quality risk and our provision for credit losses;

• The ability to identify and effectively manage risks inherent in our businesses;

• How we choose to redeploy available capital, including the extent and

timing of any share repurchases and acquisitions or other investments in

our businesses;

• The impact, extent and timing of technological changes, the adequacy of

intellectual property protection, and costs associated with obtaining rights

in intellectual property claimed by others;

• The timing and pricing of any sales of loans or other financial assets held

for sale;

• Our ability to obtain desirable levels of insurance and to successfully submit

claims under applicable insurance policies;

• The relative and absolute investment performance of assets under

management;

• The extent of terrorist activities and international hostilities, increases or

continuations of which may adversely affect the economy and financial and

capital markets generally or us specifically; and

• Issues related to the completion of our pending acquisition of Riggs National

Corporation and the integration of the remaining Riggs businesses into PNC,

including the following:

• Completion of the transaction is dependent on, among other things, receipt

of stockholder and regulatory approvals and regulatory waivers the timing

of which cannot be predicted with precision at this point and which may not

be received at all;

• Successful completion of the transaction and our ability to realize the

benefits that we anticipate from the acquisition also depend on the nature

of any future developments with respect to Riggs’ regulatory and legal

issues, the ability to comply with the terms of all current or future require-

ments (including any related action plan) resulting from these issues, and

the extent of future costs and expenses arising as a result of these issues,

including the impact of increased litigation risk and any claims for indem-

nification or advancement of costs;

• Riggs’ regulatory and legal issues may cause reputational harm to PNC

following the acquisition and integration of its business into ours;

• The transaction may be materially more expensive to complete than antici-

pated as a result of unexpected factors or events;

• The integration into PNC of the Riggs business and operations that we

acquire, which will include conversion of Riggs’ different systems and

procedures, may take longer or be more costly than anticipated and may

have unanticipated adverse results relating to Riggs’ or PNC’s existing

businesses;

• It may take longer than expected to realize the anticipated cost savings

of the acquisition, and the anticipated cost savings may not be achieved in

their entirety; and

• The anticipated strategic and other benefits of the acquisition to PNC are

dependent in part on the future performance of Riggs’ business, and there

can be no assurance as to actual future results, which could be affected by

various factors, including the risks and uncertainties generally related to

the performance of PNC’s and Riggs’ businesses (with respect to Riggs,

you may review Riggs’ SEC reports, which are accessible on the SEC’s

website at www.sec.gov) or due to factors related to the acquisition of Riggs

and the process of integrating Riggs’ business at closing into PNC.

In addition to the pending Riggs acquisition, we grow our business from time

to time by acquiring other financial services companies. Other acquisitions

generally present similar risks to those described above relating to the Riggs

transaction. We could also be prevented from pursuing attractive acquisition

opportunities due to regulatory restraints.

You can find additional information on the foregoing risks and uncertainties and

additional factors that could affect results anticipated in our forward-looking

statements or from historical performance in the reports that we file with the

SEC. You can access our SEC reports on the SEC’s website at www.sec.gov or

on or through our corporate website at www.pnc.com.

Also, BlackRock’s SEC reports (accessible on the SEC’s website or on

BlackRock’s website at www.blackrock.com) discuss in more detail those

risks and uncertainties that involve BlackRock that could affect the results

anticipated in forward-looking statements or from historical performance. You

may review the BlackRock SEC reports for a more detailed discussion of those

risks and uncertainties and additional factors as they may affect BlackRock.

34 2004 PNC Summary Annual Report