PNC Bank 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

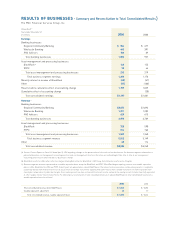

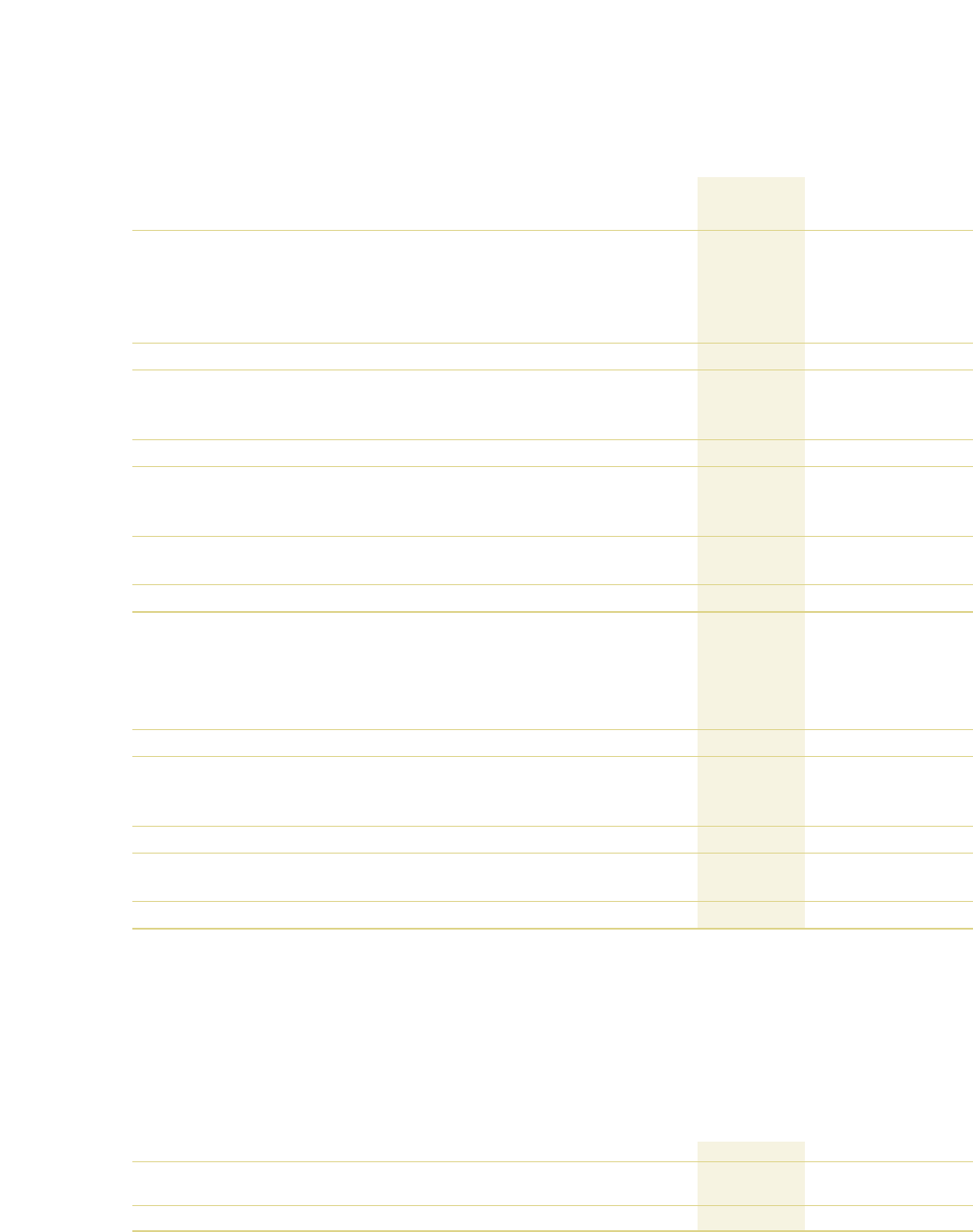

RESULTS OF BUSINESSES - Summary and Reconciliation to Total Consolidated Results}

The PNC Financial Services Group, Inc.

(Unaudited) (a)

Year ended December 31

In millions 2004 2003

Earnings

Banking businesses

Regional Community Banking $ 504 $ 477

Wholesale Banking 443 391

PNC Advisors 106 89

Total banking businesses 1,053 957

Asset management and processing businesses

BlackRock (b) 143 155

PFPC 70 64

Total asset management and processing businesses 213 219

Total business segment earnings 1,266 1,176

Minority interest in income of BlackRock (42) (47)

Other (27) (100)

Results before cumulative effect of accounting change 1,197 1,029

Cumulative effect of accounting change (28)

Total consolidated earnings $1,197 $1,001

Revenue (c)

Banking businesses

Regional Community Banking $2,073 $1,892

Wholesale Banking 1,271 1,282

PNC Advisors 629 615

Total banking businesses 3,973 3,789

Asset management and processing businesses

BlackRock 725 598

PFPC 814 762

Total asset management and processing businesses 1,539 1,360

Total business segment revenue 5,512 5,149

Other 40 114

Total consolidated revenue $5,552 $5,263

(a) See our Current Report on Form 8-K dated April 5, 2004 regarding changes to the presentation of the results of our businesses. Our business segment information is

presented based on our management accounting practices and our management structure. We refine our methodologies from time to time as our management

accounting practices are enhanced and our businesses change.

(b) BlackRock results for 2004 reflect after-tax charges totaling $66 million for BlackRock’s 2002 Long-Term Retention and Incentive Program.

(c) Business segment revenue is presented on a taxable-equivalent basis except for BlackRock and PFPC. BlackRock began reporting revenue on a taxable-equivalent

basis in 2004. BlackRock for 2003 and PFPC for both years are presented on a book (GAAP) basis. The interest income earned on certain earning assets is completely

or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. In order to provide more

meaningful comparisons of yields and margins for all earning assets, we have increased the interest income earned on tax-exempt assets to make them fully equivalent

to other taxable interest income investments. The following is a reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a

taxable-equivalent basis (in millions):

2004 2003

Total consolidated revenue, book (GAAP) basis $ 5,532 $ 5,253

Taxable-equivalent adjustment 20 10

Total consolidated revenue, taxable-equivalent basis $ 5,552 $ 5,263