PNC Bank 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

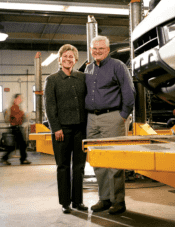

A SMALL WORLD GROWS

Small World Toys, based in Culver City, California, had

been manufacturing and distributing high quality toys

for 30 years when, in May 2004, it was purchased from

a private owner and then became a public company,

Small World Kids.

The company’s two divisions, Small World Toys and SW Express, sell toys that

promote healthy minds and bodies under several well-known brands, including

IQ Baby, Puzzibilities, All About Baby and Active Edge.

As a public company, growth was imperative for Small World Kids, and when

its leaders saw an opportunity to add the complementary brand Neurosmith

to its stable, PNC Business Credit stepped in with an attractive $16.5 million

credit facility to support the acquisition, as well as Small World’s existing

operations. The result: an ambitious company had its opportunity to grow, and

PNC Business Credit had earned another important long-term relationship.

Business Credit reach

PNC Business Credit’s success on behalf of Small World Kids provides one

snapshot from a year of remarkable growth for this business unit, which now

manages more than $10 billion in commitments. PNC Business Credit closed

118 deals in 2004, an increase of 27 percent over the prior year.

Much of this growth can be attributed to the expanding national scope of

the business unit, which operates from 25 offices from New York to Chicago

to Los Angeles, and to a primary advantage the unit has over many of its

competitors: It can rely on PNC’s broad product range, including merger

and acquisition advice, debt underwriting and treasury management, to win

clients. Armed with this array of products and a national prospect list, the

expanded PNC Business Credit sales force can deliver creative, fast action

to a growing customer base.

Wholesale Growth

Nearly half of PNC’s revenue in the

Wholesale Banking segment – and nearly

two-thirds of our consolidated revenue –

comes from noninterest sources, which is a

good proxy for the success of our fee-based

businesses. Several fee-based product

lines produced exceptional results in 2004,

highlighted by record revenue at Midland

Loan Services and good performance

from Treasury Management and Capital

Markets. These fee-based products within

a traditionally credit-driven segment of

our company provide important earnings

diversification.

10 2004 PNC Summary Annual Report

ACCELERATE}