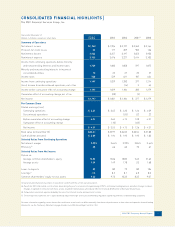

PNC Bank 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have built a powerful engine for

growth. Now our challenge, both simple

and complex, is execution.

Strength across businesses

Across all of our business segments, 2004 was a year of progress and growth.

In the community bank, an eight percent increase in checking account

relationships – the keystone of broader customer relationships – significantly

outpaced the population growth of our primary banking region, and our

renewed emphasis on small business banking produced exceptional results.

We charged branch managers to call on more small business prospects and

added more dedicated sales people, which contributed to a 13 percent increase

in relationships and a 65 percent increase in small business loan production.

The wholesale business experienced dramatic improvements in asset quality,

leading to a significantly reduced provision, and made substantial gains across

customer segments. Several fee-based products within Wholesale produced

strong growth, including record revenues from Midland Loan Services.

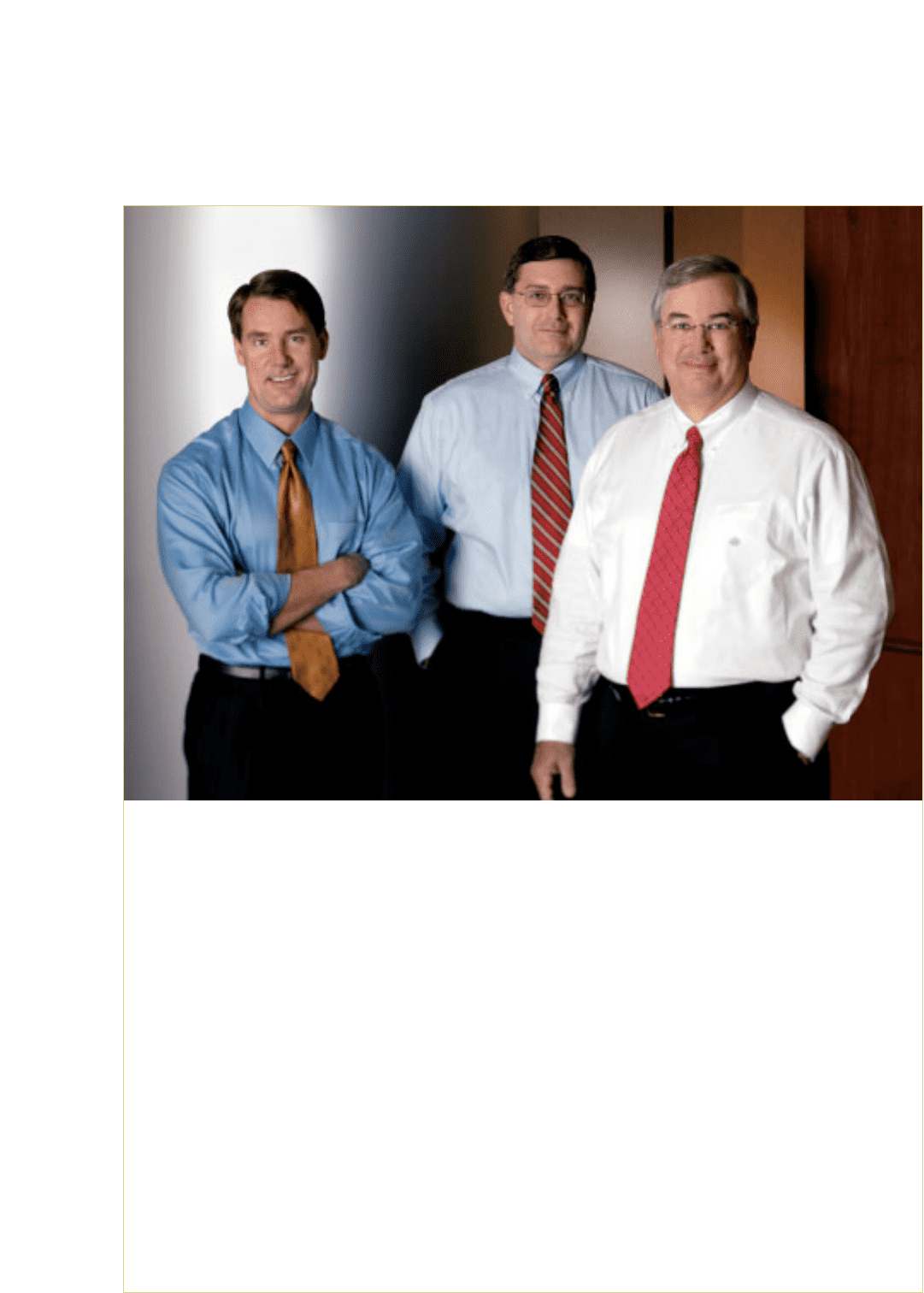

James E. Rohr

Chairman and

Chief Executive Officer

(right)

Joseph C. Guyaux

President

(center)

William S. Demchak

Vice Chairman and

Chief Financial Officer

(left)