North Face 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

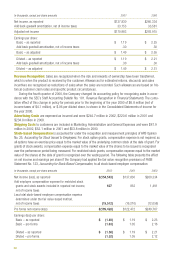

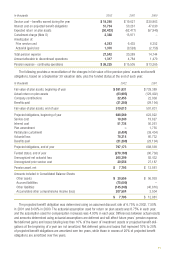

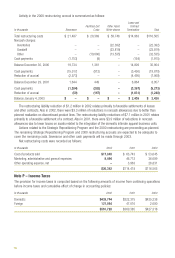

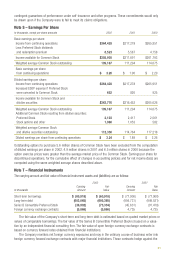

Activity in the 2000 restructuring accrual is summarized as follows:

Lease and

Facilities Exit Other Asset Contract

In thousands Severance Costs Write-downs Termination Total

Total restructuring costs $ 21,487 $ 20,369 $ 59,746 $14,963 $116,565

Noncash charges:

Inventories – – (22,392) – (22,392)

Goodwill – – (23,819) – (23,819)

Other – (19,000) (13,535) – (32,535)

Cash payments (1,753) (8) – (154) (1,915)

Balance December 30, 2000 19,734 1,361 – 14,809 35,904

Cash payments (15,517) (912) – (3,450) (19,879)

Reduction of accrual (2,573) – – (4,495) (7,068)

Balance December 29, 2001 1,644 449 – 6,864 8,957

Cash payments (1,594) (282) – (3,397) (5,273)

Reduction of accrual (50) (167) – (1,031) (1,248)

Balance January 4, 2003 $– $ – $ – $ 2,436 $ 2,436

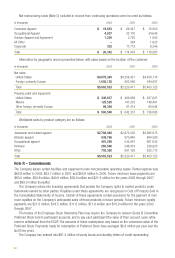

The restructuring liability reduction of $1.2 million in 2002 relates primarily to favorable settlements of leases

and other contracts. Also in 2002, there were $3.3 million of reductions in noncash allowances due to better than

planned realization on discontinued product lines. The restructuring liability reductions of $7.1 million in 2001 relates

primarily to a favorable settlement of a contract. Also in 2001, there were $3.9 million of reductions in noncash

allowances due to lower losses on assets related to the integration of the domestic intimate apparel business units.

Actions related to the Strategic Repositioning Program and the 2000 restructuring are proceeding as planned.

The remaining Strategic Repositioning Program and 2000 restructuring accruals are expected to be adequate to

cover the remaining costs. Severance and other cash payments will be made through 2003.

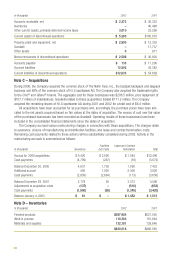

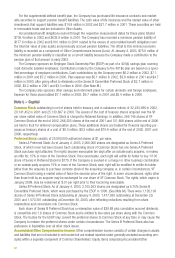

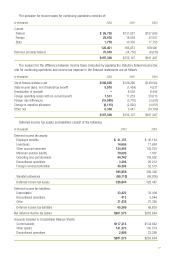

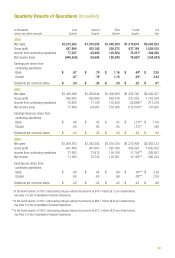

Net restructuring costs were recorded as follows:

In thousands 2002 2001 2000

Cost of products sold $17,848 $ 63,743 $ 53,645

Marketing, administrative and general expenses 8,494 46,712 36,089

Other operating expense, net –3,963 26,831

$26,342 $114,418 $116,565

Note P – Income Taxes

The provision for income taxes is computed based on the following amounts of income from continuing operations

before income taxes and cumulative effect of change in accounting policies:

In thousands 2002 2001 2000

Domestic $439,744 $322,375 $425,238

Foreign 121,984 47,010 2,080

$561,728 $369,385 $427,318