North Face 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

DEPARTMENT STORES

VANITY FAIR

LILY OF FRANCE

TOMMY HILFIGER*

NATORI*

LOU

BOLERO

GEMMA

MASS MARKET

VASSARETTE

BESTFORM

CURVATION

CHANNELS OF DISTRIBUTION (*LICENSED BRAND) > UNITED STATES

BOUTIQUES AND

DEPARTMENT STORES

LOU

BOLERO

GEMMA

INTIMA CHERRY

BELCOR

VANITY FAIR

MAJESTIC

MASS MARKET

VARIANCE

BESTFORM

VASSARETTE

CHANNELS OF DISTRIBUTION > INTERNATIONAL

a lack of intimate apparel products that combined both beauty and

function while meeting their fit and comfort needs. CurvationTM lingerie

will fulfill these needs, beautifully.

A big accomplishment in 2002 was the integration of our Bestform and

Vanity Fair Intimates businesses, which contributed to an improvement

in profitability for the year. Product development, operations and finance

were consolidated, allowing for closer collaboration among our brands

and a more efficiently managed organization. We also extended our

systems capabilities in such areas as product development, Retail Floor

Space Management (RFSM) and production planning, resulting in a big

improvement in inventory management.

Our strong portfolio of brands in France and Spain continues to meet

the fashion demands of European customers. We made substantial

changes in 2002 to improve customer service from a lower cost

business platform.

Our Global Intimates coalition management team is energized and

looking forward to a very successful 2003.

LILY OF FRANCE

VANITY FAIR

36

Despite generally lackluster industry conditions in the U.S. that

resulted in a slight decline in sales, our brands’ focus on continuous

product innovation generated market share gains in both department

and chain stores. We also added more marketing muscle to our

brands, with a 25% increase in advertising spending in 2002.

Our department and chain store business grew in 2002, with market

share gains in the bra, panty and daywear categories. Our biggest

brand, Vanity Fair®

,enjoyed strong growth in the bra and panty

categories. The Lily of France®brand saw success from its Value

In Style®collection, featuring everyday, value-priced bras.

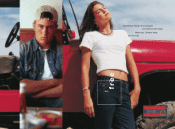

Our licensed Tommy Hilfiger ®business had a spectacular year, with

sales fueled by a national advertising campaign featuring two new

bra introductions: the Oxford Collection and Tommy Essentials.

MASS APPEAL

Our mass market Bestform®and Vassarette®brands had mixed results

in 2002. The Bestform®brand, which features casual, cotton-based

bras, had a very good year. On the other hand, our Vassarette®

brand has faced challenges during the past couple of years. We’re

responding on both the product and marketing fronts. A significant

update to the Vassarette®brand’s assortment is planned this year,

including an innovative stretch foam pad product. New packaging

and print advertising will put a fresh face on the brand in 2003.

We’re building new business in the mass market with our launch

of the CurvationTM brand. Real women with real curves were the

inspiration behind the line. These women were often frustrated by

GLOBAL INTIMATE APPAREL VANITY FAIR

LILY OF FRANCE

VASSARETTE

BESTFORM

CURVATION

NATORI*

TOMMY HILFIGER*

LOU

BOLERO

GEMMA

INTIMA CHERRY

BELCOR

VARIANCE

MAJESTIC

*LICENSED BRAND

Intimate apparel is VF’s

second largest product

category, accounting

for 17% of total sales.

CURVATION