North Face 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

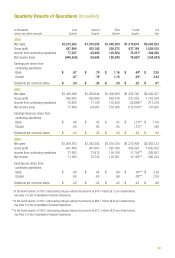

73

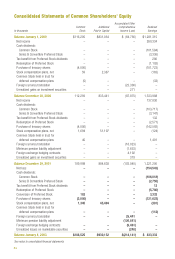

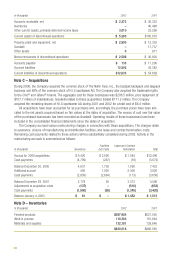

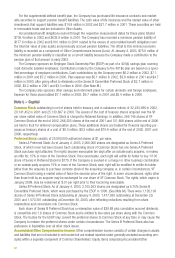

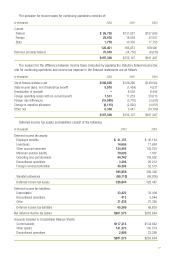

Comprehensive Income in the Consolidated Balance Sheets are summarized, net of related income taxes, as follows:

In thousands 2002 2001

Foreign currency translation $ (80,728) $(106,169)

Minimum pension liability adjustment (128,494) (1,653)

Foreign exchange hedging contracts (5,269) 4,192

Unrealized gains on marketable securities 350 590

$(214,141) $(103,040)

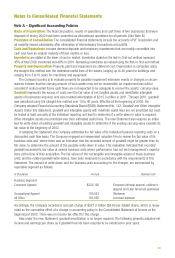

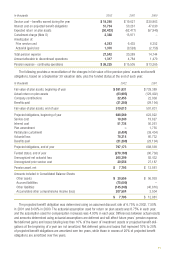

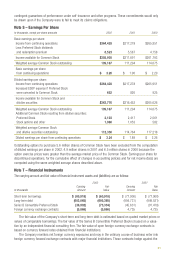

Note M – Redeemable Preferred Stock

The Series B Convertible Preferred Stock (Note L) was purchased by the ESOP in 1990. The ESOP’s purchase of

the preferred shares was funded by a loan of $65.0 million from the Company; this loan was repaid through

2002. Interest income on this loan was $.1 million in 2002, $.9 million in 2001 and $1.7 million in 2000.

Principal and interest obligations on the loan were satisfied as the Company made contributions to the savings

plan and dividends were paid on the Preferred Stock. As principal payments were made on the loan, shares of

Preferred Stock were allocated to participating employees’ accounts within the ESOP. By the end of 2002, all

shares of Preferred Stock had been allocated to participating employees’ accounts.

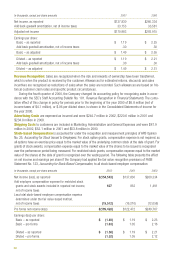

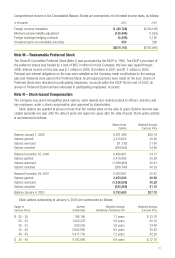

Note N – Stock-based Compensation

The Company may grant nonqualified stock options, stock awards and restricted stock to officers, directors and

key employees under a stock compensation plan approved by shareholders.

Stock options are granted at prices not less than fair market value on the date of grant. Options become exer-

cisable generally one year after the date of grant and expire ten years after the date of grant. Stock option activity

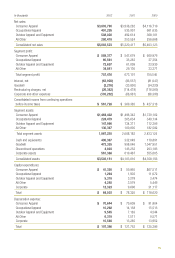

is summarized as follows:

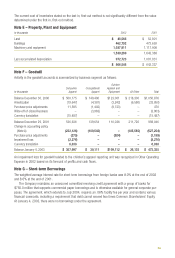

Shares Under Weighted Average

Options Exercise Price

Balance January 1, 2000 6,631,496 $36.74

Options granted 2,213,025 26.20

Options exercised (51,130) 21.60

Options canceled (294,500) 34.46

Balance December 30, 2000 8,498,891 34.17

Options granted 2,419,090 35.59

Options exercised (1,699,860) 26.41

Options canceled (208,140) 40.33

Balance December 29, 2001 9,009,981 35.87

Options granted 2,453,000 40.90

Options exercised (1,326,026) 30.29

Options canceled (343,265) 41.16

Balance January 4, 2003 9,793,690 $37.70

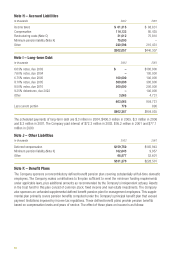

Stock options outstanding at January 4, 2003 are summarized as follows:

Range of Number Weighted Average Weighted Average

Exercise Prices Outstanding Remaining Contractual Life Exercise Price

$ 20 - 25 196,160 1.7 years $ 23.76

25 - 30 1,260,270 5.9 years 26.15

30 - 35 859,550 3.9 years 34.49

35 - 40 2,065,960 8.2 years 35.63

40 - 45 5,411,750 7.2 years 42.20

$ 20 - 45 9,793,690 6.9 years $ 37.70