North Face 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

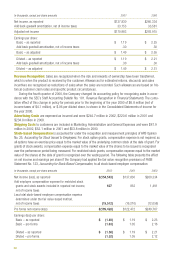

•On an overall basis, operating margins for ongoing businesses should reach 13% of sales.

•Net interest expense should decline $10 million from the 2002 level.

•Earnings per share should advance 5 – 10% in 2003.

•Considering the contribution of $75.0 million to our pension plan already made in 2003, we expect cash flow

from operations to approximate $400 million. This is down from the high level of the last two years and more

in line with historical levels.

•For the first quarter of 2003, sales are expected to be up slightly, and earnings per share are expected to be up

approximately 10%.

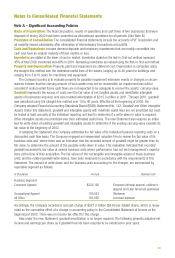

Risk Management

The Company is exposed to a variety of market risks in the ordinary course of business. We regularly assess these

potential risks and manage the Company’s exposures to these risks through its operating and financing activities

and, when appropriate, by utilizing natural hedges and by creating offsetting positions through the use of deriva-

tive financial instruments. We do not use derivative financial instruments for trading or speculative purposes.

We limit the risk of interest rate fluctuations on net income and cash flows by managing the Company’s mix

of fixed and variable interest rate debt. In addition, although we did not do so during 2002, we may also use

derivative financial instruments to minimize our interest rate risk. Since our long-term debt has fixed interest

rates, our primary interest rate exposure relates to changes in interest rates on short-term borrowings, which

averaged $72 million during 2002. However, any change in interest rates would also affect interest income

earned on the Company’s cash equivalents on deposit. Based on average amounts of short-term borrowings

and of cash on deposit during 2002, the effect of a hypothetical 1% change in interest rates on reported net

income would not be material.

The Company has foreign businesses that operate in functional currencies other than the United States dollar

(except in Turkey and Argentina, where we use the United States dollar because of their high inflation economies).

Assets and liabilities in these foreign businesses are subject to fluctuations in foreign currency exchange rates.

Investments in these primarily European and Latin American businesses are considered to be long-term invest-

ments, and accordingly, foreign currency translation effects on those net assets are included as a component of

Accumulated Other Comprehensive Income in Common Shareholders’ Equity. We do not hedge these net invest-

ments and do not hedge the translation of foreign currency operating results into the United States dollar.

A growing percentage of the total product needs to support our domestic and European businesses are manu-

factured in our plants in foreign countries or by foreign contractors. We monitor net foreign currency market expo-

sures and may in the ordinary course of business enter into foreign currency forward exchange contracts to hedge

specific foreign currency transactions or anticipated cash flows. Use of these financial instruments allows us to

reduce the Company’s overall exposure to exchange rate movements, since gains and losses on these contracts

will offset the losses and gains on the transactions being hedged. Our practice during 2002 and 2001 was to

hedge a portion of our significant net foreign currency cash flows, by buying or selling United States dollar con-

tracts against various currencies, relating to cross-border inventory purchases and production costs, product sales

and intercompany royalty payments anticipated for the following 12 months. Hedging was not significant

during 2000.

If there were a hypothetical adverse change in foreign currency exchange rates of 10% relative to the United

States dollar, the expected effect on the fair value of the hedging contracts outstanding at January 4, 2003 would

be approximately $14 million. Based on changes in the timing and amount of foreign currency exchange rate

movements, actual gains and losses could differ.

The Company has various nonqualified deferred compensation plans in which liabilities accrued for the plans’

participants are based on market values of investment funds that are selected by participants. The risk of changes

in the market values of the participants’ underlying investment selections is hedged by the Company’s investments

in a portfolio of securities, including variable life insurance contracts, that substantially mirror the investment