North Face 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

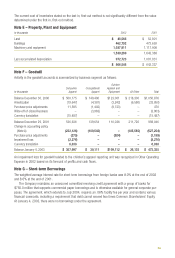

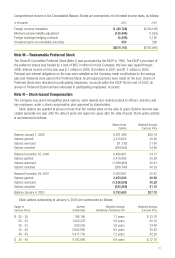

In thousands 2002 2001

Accounts receivable, net $ 2,273 $ 30,322

Inventories –46,489

Other current assets, primarily deferred income taxes 3,010 23,268

Current assets of discontinued operations $ 5,283 $100,079

Property, plant and equipment, net $ 2,500 $ 12,355

Goodwill –17,737

Other assets 6811

Noncurrent assets of discontinued operations $ 2,506 $ 30,903

Accounts payable $ 133 $ 11,296

Accrued liabilities 12,502 43,342

Current liabilities of discontinued operations $12,635 $ 54,638

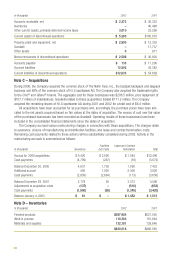

Note C – Acquisitions

During 2000, the Company acquired the common stock of The North Face, Inc., the Eastpak backpack and daypack

business and 85% of the common stock of H.I.S sportswear AG. The Company also acquired the trademark rights

to the Chic®and Gitano®brands. The aggregate cost for these businesses was $206.5 million, plus repayment of

$107.7 million of indebtedness. Goodwill related to these acquisitions totaled $171.2 million. The Company

acquired the remaining shares of H.I.S sportswear AG during 2001 and 2002 for a total cost of $6.4 million.

All acquisitions have been accounted for as purchases and, accordingly, the purchase prices have been allo-

cated to the net assets acquired based on fair values at the dates of acquisition. The excess of cost over fair value

of the purchased businesses has been recorded as Goodwill. Operating results of these businesses have been

included in the consolidated financial statements since the dates of acquisition.

The Company accrued various restructuring charges in connection with these acquisitions. The charges relate

to severance, closure of manufacturing and distribution facilities, and lease and contract termination costs.

Remaining cash payments related to these actions will be substantially completed during 2003. Activity in the

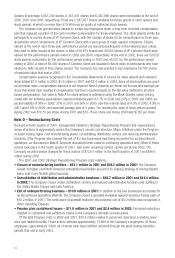

restructuring accruals is summarized as follows:

Facilities Lease and Contract

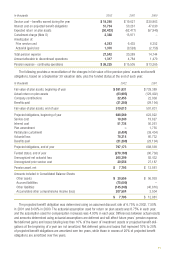

In thousands Severance Exit Costs Termination Total

Accrual for 2000 acquisitions $ 9,426 $ 2,026 $ 1,044 $12,496

Cash payments (4,789) (267) (18) (5,074)

Balance December 30, 2000 4,637 1,759 1,026 7,422

Additional accrual 400 1,020 2,400 3,820

Cash payments (2,859) (2,684) (113) (5,656)

Balance December 29, 2001 2,178 95 3,313 5,586

Adjustments to acquisition costs (137) – (516) (653)

Cash payments (1,980) (95) (1,345) (3,420)

Balance January 4, 2003 $ 61 $ – $ 1,452 $ 1,513

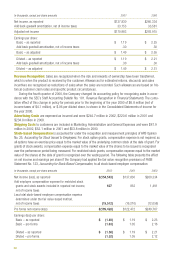

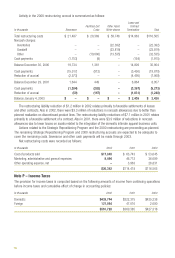

Note D – Inventories

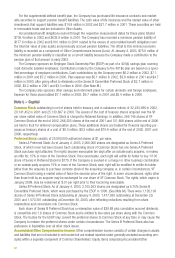

In thousands 2002 2001

Finished products $587,954 $621,055

Work in process 110,383 116,864

Materials and supplies 132,181 128,646

$830,518 $866,565