North Face 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

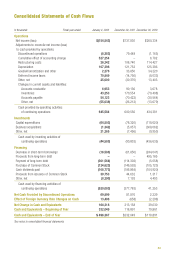

Liquidity and Cash Flows

In managing its capital structure, management’s goal is to maintain a debt to capital ratio of less than 40%, pro-

viding flexibility to pursue investment opportunities that may become available. Our debt to capital ratio remains

below these guidelines: 28.6% at the end of 2002 and 31.7% at the end of 2001. Net of cash, our debt to capital

ratio at the end of 2002 was 9.2%.

Working capital was $1,199.7 million and the current ratio was 2.4 to 1 at the end of 2002, compared with

$1,217.6 million and 2.5 to 1 at the end of 2001.

The primary source of liquidity is the Company’s strong cash flow provided by continuing operations, which

was $645.6 million in 2002, $600.6 million in 2001 and $434.4 million in 2000. Cash flow from continuing oper-

ations was at a higher than normal level in the last two years due to inventory and accounts receivable reductions

in both years and, in 2002, the higher level of income (exclusive of the accounting change) and lower income

tax payments in that year. In addition, cash flow from discontinued operations totaled $69.9 million in 2002

and $81.9 million in 2001 from liquidation of working capital and, in 2002, from sale of the Jantzen business

and other assets.

VF maintains a $750.0 million unsecured committed bank facility that expires in July 2004. This bank facility

supports a $750.0 million commercial paper program. Any issuance of commercial paper would reduce the

amount available under the bank facility. At the end of 2002, there were no commercial paper or bank borrowings

against this facility. Further, under a Registration Statement filed in 1994 with the Securities and Exchange

Commission, the Company has the ability to offer, on a delayed or continuous basis, up to $300 million of

additional debt, equity or other securities as market opportunities present themselves.

In February 2003, Standard & Poors confirmed its ‘A minus’ long-term corporate credit and senior unsecured

debt ratings for VF, as well as its ‘A-2’ short-term credit and commercial paper ratings. Their ratings outlook is

“stable.” In June 2002, Moody’s Investors Service confirmed its ratings of ‘A2’ for VF’s senior unsecured debt and

‘Prime-1’ for commercial paper based on the value of VF’s brands, its strong market share in the jeans business

and the strength of its systems which allow the Company to effectively manage inventory risks. While Moody’s

confirmed the Company’s ratings, they did revise their rating outlook from “stable” to “negative” based on declines

in sales volume at the domestic jeanswear business and reductions in the level of operating profitability. Based on

current conditions, we believe that a negative rating change by Moody’s, if one were to occur, from ‘A2’ to ‘A3’ for

senior debt and from ‘Prime-1’ to ‘Prime-2’ for commercial paper would not have a material impact on the

Company’s financial results or on the ability to issue commercial paper. Existing debt agreements do not contain

acceleration of maturity clauses based on changes in credit ratings.

Capital expenditures were $64.5 million in 2002, compared with $78.3 million and $118.6 million in 2001

and 2000, respectively. Capital expenditures in 2002 generally relate to maintenance spending in our worldwide

manufacturing and other facilities. We expect that capital spending could reach $100 million in 2003, with the

increase over the last two years due to completion of spending on lower cost jeanswear capacity in Mexico and a

distribution center in Europe. Capital spending in 2003 will be funded by cash flow from operations.

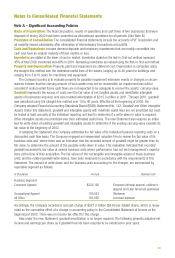

As discussed in the previous section, accumulated benefit obligations in the Company’s defined benefit pension

plans exceeded the fair value of plan assets by $220.3 million at the plans’ latest valuation date. We believe that

retirement benefits are important for our associates, and accordingly, we are committed to maintaining a well-

funded pension plan. Although the Company will not be required by applicable law to make any funding contribution

to the qualified pension plan trust in 2003, we made a $75.0 million cash contribution to the plan in February 2003.

This contribution was significantly higher than our average annual contribution of $20 million over the last two years

and addresses a significant portion of the underfunded status. Based on current circumstances, this $75.0 million

contribution should result in a reduction of the same amount in the minimum pension liability and the charge to

Other Comprehensive Income at the end of 2003. We will continue to monitor the funded status of the plan and

evaluate future funding levels. The Company has adequate liquidity to meet future funding requirements.

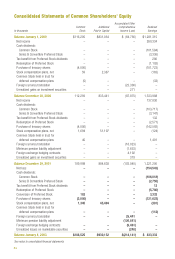

By early 2002, all of the Series B ESOP Convertible Preferred Stock had been allocated to participant accounts

in the 401(k) savings plan. Accordingly, Company matching contributions to the savings plan are now made in

cash instead of Preferred Stock. This change will not have a significant effect on the Company’s liquidity.