North Face 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

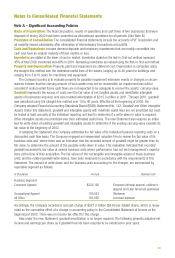

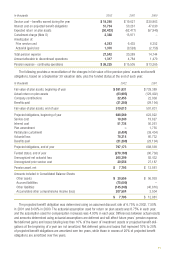

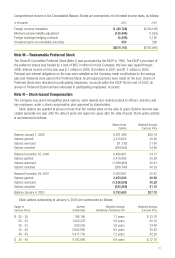

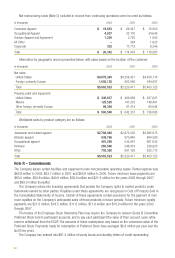

Options to purchase 6,061,240 shares, 6,447,041 shares and 6,332,066 shares were exercisable at the end of

2002, 2001 and 2000, respectively. There are 5,347,657 shares available for future grants of stock options and

stock awards, of which no more than 970,964 may be grants of restricted stock awards.

The Company has granted stock awards to certain key employees under a long-term incentive compensation

plan that replaced a portion of the cash incentive compensation for those employees. The stock awards entitle the

participants to receive shares of VF Common Stock, with the number of shares to be earned based on three year

shareholder return comparisons of VF Common Stock with a peer group of major apparel companies. Shares

earned at the end of each three-year performance period are issued to participants in the following year, unless

they elect to defer receipt of the shares. A total of 56,819 shares and 39,923 shares of VF Common Stock were

earned for the performance periods ended in 2002 and 2000, respectively. At the end of 2002, there are 50,028

stock awards outstanding for the performance period ending in 2003 and 45,231 for the performance period

ending in 2004. A total of 56,430 shares of Common Stock are issuable in future years to participants who have

elected to defer receipt of their shares earned. The Company has also granted to key employees 59,704 shares

of restricted stock that vest in 2005.

Compensation expense recognized in the Consolidated Statements of Income for stock awards and restricted

stock totaled $1.0 million in 2002, $1.4 million in 2001 and $2.4 million in 2000. Since all stock options are grant-

ed at market value, compensation expense is not required. Note A presents pro forma net income and earnings per

share that would have resulted if compensation had been recorded based on the fair value method for all stock-

based compensation. Fair value in Note A for stock options is estimated using the Black-Scholes option-pricing

model with the following assumptions: expected dividend yield of 2.7% in 2002 and 2.0% in 2001 and 2000; ex-

pected volatility of 36% in 2002, 37% in 2001 and 36% in 2000; risk-free interest rates of 4.0% in 2002, 4.9% in

2001 and 6.8% in 2000; and expected average lives of 4 years. The resulting fair value of stock options granted

during 2002 was $10.51 per share, during 2001 was $10.78 per share and during 2000 was $7.66 per share.

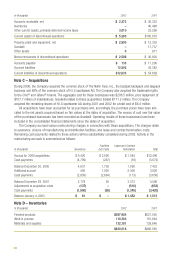

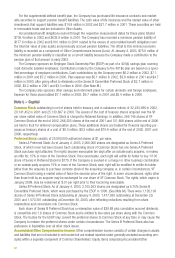

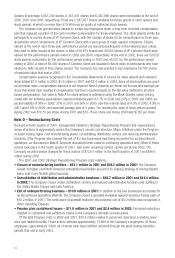

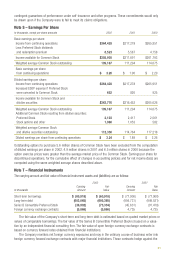

Note O – Restructuring Costs

During the fourth quarter of 2001, management initiated a Strategic Repositioning Program that represented a

series of actions to aggressively reduce the Company’s overall cost structure. Major initiatives under the Program

included closing higher cost manufacturing plants, consolidating distribution centers and reducing administrative

functions. (This Program also covered the exit of the two businesses now being accounted for as discontinued

operations, as discussed in Note B. Amounts discussed herein relate to continuing operations only.) Most of these

actions took place in the fourth quarter of 2001, with some remaining actions carried out during 2002. The

Company recorded pretax charges for these actions of $125.4 million in the fourth quarter of 2001 and $46.0

million during 2002.

The 2001 and 2002 Strategic Repositioning Program costs relate to:

• Closure of manufacturing facilities – $61.1 million in 2001 and $29.2 million in 2002: The Company

closed 30 higher cost North American manufacturing facilities as part of its ongoing strategy of moving toward

lower cost, more flexible global sourcing.

• Consolidation of distribution and administrative functions – $42.7 million in 2001 and $14.4 million

in 2002: The Company closed certain distribution centers and reduced administrative functions and staffing in

the United States, Europe and Latin America.

• Exit of underperforming business – $10.0 million in 2001: In addition to the two businesses accounted for

as discontinued operations (Note B), the Company closed a specialty workwear apparel business having sales of

$10.2 million in 2001. The write-down of goodwill related to this business unit of $4.0 million was recognized in

Other Operating Expense.

• Pension plan curtailment losses – $11.6 million in 2001 and $2.4 million in 2002: Personnel reductions

resulted in curtailment and settlement losses in the Company’s domestic pension plans.

Of the total Program costs in 2002 and 2001, $75.4 million relates to personnel reductions, including sever-

ance and related benefits. These actions affected approximately 13,600 of the Company’s employees. Of those

employees, approximately 3,800, all of whom have been notified, will work through the plant closing transition

periods that end in early 2003.