North Face 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

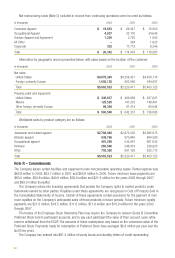

70

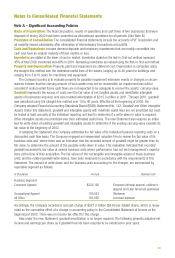

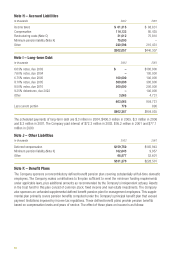

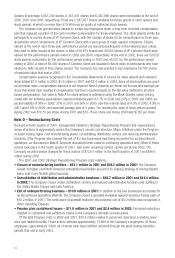

Note H – Accrued Liabilities

In thousands 2002 2001

Income taxes $ 61,315 $ 68,631

Compensation 114,132 85,435

Restructuring costs (Note O) 31,012 75,810

Minimum pension liability (Note K) 75,000 –

Other 220,598 210,431

$502,057 $440,307

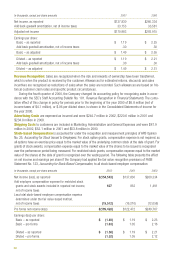

Note I – Long-term Debt

In thousands 2002 2001

6.63% notes, due 2003 $ – $100,000

7.60% notes, due 2004 –100,000

6.75% notes, due 2005 100,000 100,000

8.10% notes, due 2005 300,000 300,000

8.50% notes, due 2010 200,000 200,000

9.25% debentures, due 2022 –100,000

Other 3,065 4,731

603,065 904,731

Less current portion 778 696

$602,287 $904,035

The scheduled payments of long-term debt are $.3 million in 2004, $400.3 million in 2005, $.3 million in 2006

and $.3 million in 2007. The Company paid interest of $72.2 million in 2002, $95.2 million in 2001 and $77.1

million in 2000.

Note J – Other Liabilities

In thousands 2002 2001

Deferred compensation $159,750 $165,943

Minimum pension liability (Note K) 102,643 9,957

Other 68,877 52,601

$331,270 $228,501

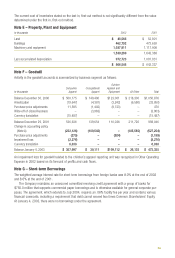

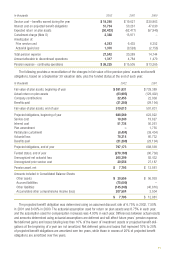

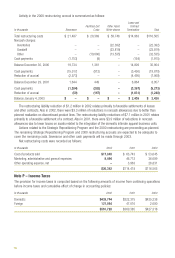

Note K – Benefit Plans

The Company sponsors a noncontributory defined benefit pension plan covering substantially all full-time domestic

employees. The Company makes contributions to the plan sufficient to meet the minimum funding requirements

under applicable laws, plus additional amounts as recommended by the Company’s independent actuary. Assets

in the trust fund for this plan consist of common stock, fixed income and real estate investments. The Company

also sponsors an unfunded supplemental defined benefit pension plan for management employees. This supple-

mental plan primarily covers pension benefits computed under the Company’s principal benefit plan that exceed

payment limitations imposed by income tax regulations. These defined benefit plans provide pension benefits

based on compensation levels and years of service. The effect of these plans on income is as follows: