North Face 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

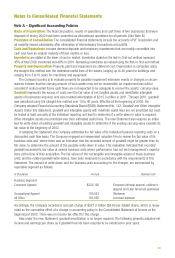

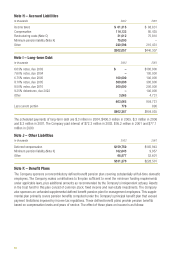

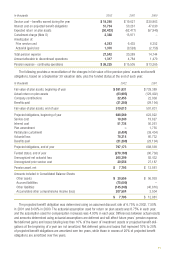

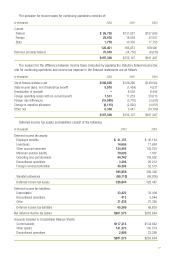

For the supplemental defined benefit plan, the Company has purchased life insurance contracts and market-

able securities to support pension benefit liabilities. The cash value of life insurance and the market value of other

investments that support liabilities was $14.8 million in 2002 and $21.7 million in 2001. These securities are held

in irrevocable trusts and are included in Other Assets.

Accumulated benefit obligations earned through the respective measurement dates for these plans totaled

$739.4 million in 2002 and $633.9 million in 2001. The Company has recorded a minimum pension liability of

$177.6 million in 2002 and $10.0 million in 2001 related to the excess of accumulated benefit obligations over

the total fair value of plan assets and previously accrued pension liabilities. The offset to this minimum pension

liability is recorded as a component of Other Comprehensive Income (Loss). At January 4, 2003, $75.0 million of

the minimum pension liability is classified as a current liability because the Company made a contribution to the

pension plan of that amount in early 2003.

The Company sponsors an Employee Stock Ownership Plan (ESOP) as part of a 401(k) savings plan covering

most domestic salaried employees. Contributions made by the Company to the 401(k) plan are based on a speci-

fied percentage of employee contributions. Cash contributions by the Company were $6.2 million in 2002, $7.1

million in 2001 and $7.2 million in 2000. Plan expense was $5.1 million in 2002, $3.8 million in 2001 and $4.7

million in 2000, after giving effect to dividends on the Series B Convertible Preferred Stock of $2.7 million in

2002, $3.2 million in 2001 and $3.3 million in 2000. (See Note M.)

The Company also sponsors other savings and retirement plans for certain domestic and foreign employees.

Expense for these plans totaled $7.7 million in 2002, $6.7 million in 2001 and $5.4 million in 2000.

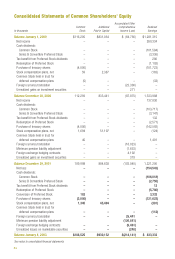

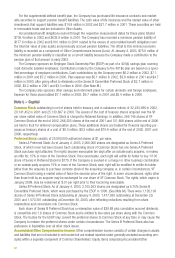

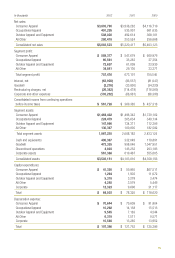

Note L – Capital

Common Stock outstanding is net of shares held in treasury, and in substance retired, of 32,233,996 in 2002,

29,141,452 in 2001 and 25,139,897 in 2000. The excess of the cost of treasury shares acquired over the $1

per share stated value of Common Stock is charged to Retained Earnings. In addition, 266,146 shares of VF

Common Stock at the end of 2002, 266,203 shares at the end of 2001 and 311,608 shares at the end of 2000

are held in trust for deferred compensation plans. These additional shares are treated for financial reporting pur-

poses as treasury shares at a cost of $9.3 million, $9.2 million and $10.6 million at the end of 2002, 2001 and

2000, respectively.

Preferred Stock consists of 25,000,000 authorized shares at $1 par value.

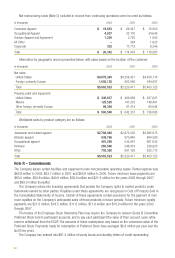

Series A Preferred Stock: As of January 4, 2003, 2,000,000 shares are designated as Series A Preferred

Stock, of which none has been issued. Each outstanding share of Common Stock has one Series A Preferred

Stock purchase right attached. The rights become exercisable ten days after an outside party acquires, or makes

an offer for, 15% or more of the Common Stock. Once exercisable, each right will entitle its holder to buy 1/100

share of Series A Preferred Stock for $175. If the Company is involved in a merger or other business combination

or an outside party acquires 15% or more of the Common Stock, each right will be modified to entitle its holder

(other than the acquirer) to purchase common stock of the acquiring company or, in certain circumstances, VF

Common Stock having a market value of twice the exercise price of the right. In some circumstances, rights other

than those held by an acquirer may be exchanged for one share of VF Common Stock. The rights, which expire in

January 2008, may be redeemed at $.01 per right prior to their becoming exercisable.

Series B Preferred Stock: As of January 4, 2003, 2,105,263 shares are designated as 6.75% Series B

Convertible Preferred Stock, which were purchased by the ESOP in 1990. (See Note M.) There were 1,195,199

shares of Series B Preferred Stock outstanding at January 4, 2003, 1,477,930 outstanding at December 29,

2001 and 1,570,301 outstanding at December 30, 2000, after reflecting reductions resulting from share

redemptions and conversions into Common Stock.

Each share of Series B Preferred Stock has a redemption value of $30.88 plus cumulative accrued dividends,

is convertible into 1.6 shares of Common Stock and is entitled to two votes per share along with the Common

Stock. The trustee for the ESOP may convert the preferred shares to Common Stock at any time or may cause the

Company to redeem the preferred shares under certain circumstances. The Series B Preferred Stock also has

preference in liquidation over all other stock issues.

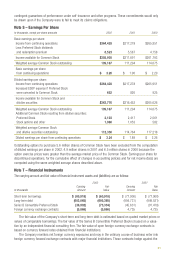

Accumulated Other Comprehensive Income: Other comprehensive income consists of certain changes in assets

and liabilities that are not included in net income but are instead reported under generally accepted accounting prin-

ciples within a separate component of Common Shareholders’ Equity. Items comprising Accumulated Other