North Face 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

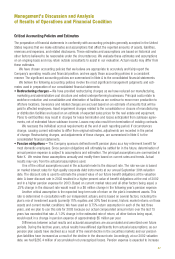

Sales

Dollars in millions

Sales declined slightly in

2002, reflecting weak retail

conditions.

5,403

00 01 02

5,220 5,084

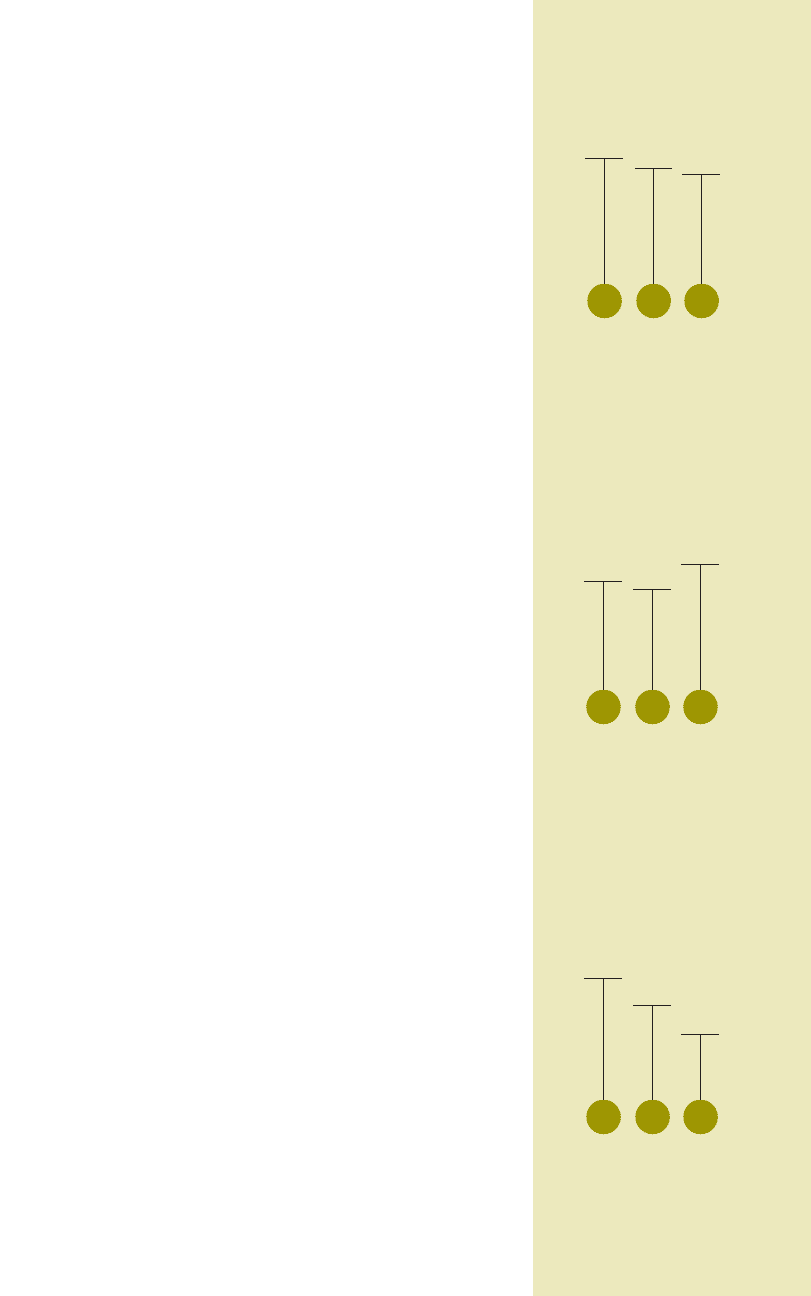

Debt to Capital Ratio

Percent

Long-term debt was reduced

by over $300 million in 2002.

Net of cash, debt is only 9.2%

of total capital.

34.7

00 01 02

31.7

28.6

00 01 02

Gross Margin

Percent to sales

Moves to lower cost sourcing

boosted gross margins

significantly in 2002.

33.9 32.9

36.0

48

by $34 million in 2003 primarily due to amortization of these deferred loss-

es, as well as the impact of reduced investment assets and a lower dis-

count rate at our 2002 valuation date.

Our estimated accumulated benefit obligations exceeded the fair value

of plan assets at our most recent valuation date. Accordingly, we have

recorded a minimum pension liability of $177.6 million. The amount of the

liability, along with the related charge to Common Shareholders’ Equity,

could change significantly in future years depending on market fluctuations

affecting actual earnings of the pension plan assets, interest rates and the

level of Company contributions to the plan. To improve the funded status of

the plan, the Company made a $75.0 million contribution to the plan in

February 2003.

•Long-lived assets – Our depreciation policies reflect judgments on the

estimated economic lives of our property, plant and equipment assets. We

review our property, plant and equipment for possible impairment whenever

events or circumstances indicate that the carrying amount of an asset may

not be fully recoverable. We measure recoverability of the carrying value of

these assets by comparison with undiscounted cash flows expected to be

generated by those assets. These evaluations have not resulted in any

significant impairment adjustments to property, plant and equipment

during the past three years, except for those made in conjunction with

restructuring actions.

In connection with our adoption of FASB Statement No. 142, Goodwill

and Other Intangible Assets,as of the beginning of 2002, we performed a

review of our goodwill for possible impairment. The review required that we

estimate the fair value of our business units having goodwill. Fair value was

based on the present value of expected future cash flows, which required

judgment and estimation about future market conditions, future sales and

profitability, and a discount rate commensurate with the risk inherent in

each business unit. We engaged an independent valuation firm to review

the fair value of the Company’s business units. The write-down resulting

from this review was recorded as the cumulative effect of a change in

accounting policy as of the beginning of 2002.

This Statement also requires us to reevaluate goodwill in all business

units at least annually, or more frequently if there is an indication of possi-

ble impairment. We performed this annual review during the fourth quarter

of 2002. For most of the Company’s remaining goodwill, the indicated fair

value of the goodwill in the respective business units substantially exceed-

ed the carrying amount of that goodwill, and no further evaluation was nec-

essary in 2002. For one smaller business unit, we determined that $2.3

million of goodwill was impaired and, accordingly, recorded an impairment

charge in the fourth quarter of 2002.

•Inventories – Our inventories are stated at the lower of cost or market

value. We review all of our inventory each quarter on the basis of individual

style-size-color stockkeeping units (SKUs) to identify excess or slow moving

products, discontinued and to-be-discontinued product lines, and off-quality

merchandise. This review covers inventory on hand, as well as current produc-

tion or purchase commitments. For those units in inventory that are so identi-

fied, we estimate their market value based on current realization trends. The

evaluation, performed using a systematic and consistent methodology, requires

forecasts of future demand, market conditions and selling prices. If the fore-

casted market value is less than cost, we provide an allowance to reflect the