National Grid 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

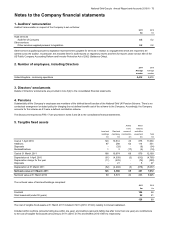

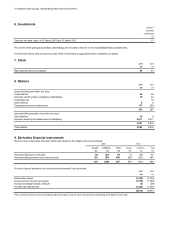

78 National Grid Gas plc Annual Report and Accounts 2010/11

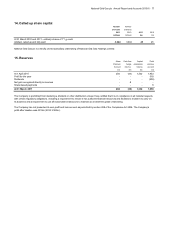

16. Commitments and contingencies

a) Future capital expenditure

b) Lease commitments

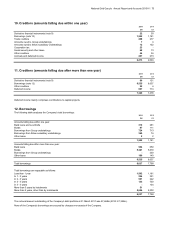

Land and buildings Other Total

2011 2010 2011 2010 2011 2010

£m £m £m £m £m £m

Expiring:

In one year or less -11112

In more than one year, but not more than five years 554499

In more than five years 54--54

10 10 5515 15

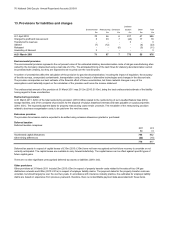

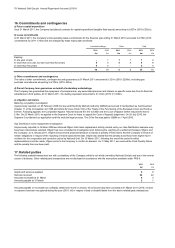

c) Other commitments and contingencies

d) Parent Company loan guarantees on behalf of subsidiary undertaking

s

e) Litigation and claims

Metering competition investigation

Gas Distribution mains replacement investigation

17. Related parties

2011 2010

£m £m

Goods and services supplied 98

Services received 22 22

A

mounts receivable at 31 March 63

A

mounts payable at 31 March 21

Amounts payable or receivable are ordinarily settled one month in arrears. No amounts have been provided at 31 March 2011 (2010: nil) and

no expense has been recognised during the year (2010: nil) in respect of bad or doubtful debts from the above related party transactions.

As previously reported, in October 2008 we informed Ofgem that mains replacement activity carried out by our Gas Distribution business may

have been inaccurately reported. Ofgem has now concluded its investigation and, following the reaching of a settlement between Ofgem and

the Company, on 6 January 2011, Ofgem announced its proposed decision to impose a penalty of £8m and to find the Company in breach of

certain obligations in respect of the reporting of mains replacement data. Ofgem also stated that the penalty would have been higher had it

not been for the cooperation and corrective action by National Grid. On 10 March 2011, following the end of the period in which

representations could be made, Ofgem wrote to the Company to confirm its decision. On 13 May 2011, we received the Final Penalty Notice

and the penalty has now been paid.

As previously reported, on 25 February 2008 the Gas and Electricity Markets Authority (GEMA) announced it had decided we had breached

Chapter 11 of the Competition Act 1998 and Article 82 (now Article 102) of the Treaty of the Functioning of the European Union and fined us

£41.6m. Following appeals, the Competition Appeal Tribunal reduced the fine to £30m and the Court of Appeal further reduced the fine to

£15m. On 22 March 2010, we applied to the Supreme Court for leave to appeal the Court of Appeal's judgement. On 28 July 2010, the

Supreme Court denied our application and this ends the legal process. The £15m fine was paid to GEMA on 1 April 2010.

The Company has guaranteed the repayment of principal sums, any associated premium and interest on specific loans due from its financial

subsidiaries to third parties. At 31 March 2011, the sterling equivalent amounted to £1,104m (2010: £1,168m).

At 31 March 2011, the Company’s total operating lease commitments for the financial year ending 31 March 2012 amounted to £15m (2010

commitments for 2011: £15m) and are analysed by lease expiry date as follows:

As at 31 March 2011, the Company had placed contracts for capital expenditure (tangible fixed assets) amounting to £427m (2010: £532m).

The following material transactions are with a subsidiary of the Company which is not wholly owned by National Grid plc and are in the normal

course of business. Other related party transactions are not disclosed in accordance with the exemptions available under FRS 8.

The value of other commitments, contingencies and guarantees at 31 March 2011 amounted to £121m (2010: £209m), including gas

purchase commitments amounting to £102m (2010: £43m).