National Grid 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

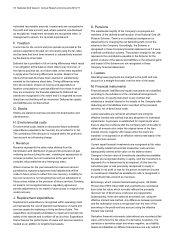

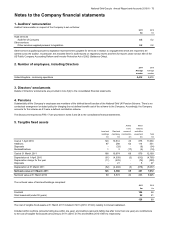

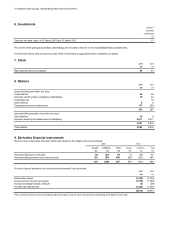

76 National Grid Gas plc Annual Report and Accounts 2010/11

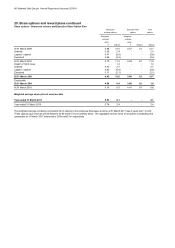

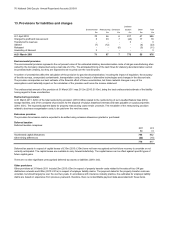

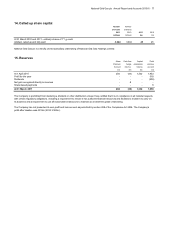

13. Provisions for liabilities and charges

Deferred

Environmental Restructuring Emissions taxation Other Total

£m £m £m £m £m £m

A

t 1 April 2010 70 46 6 817 47 986

Charged to profit and loss account 5 33 7 (44) 17 18

Transferred to reserves - - - 3 - 3

Utilised (7) (12) - - (4) (23)

Released - - (6) - (5) (11)

Unwinding of discoun

t

3----3

At 31 March 2011 71 67 7 776 55 976

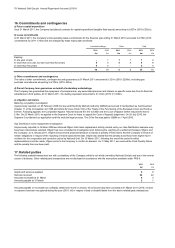

Environmental provision

Restructuring provision

Emissions provision

Deferred taxation

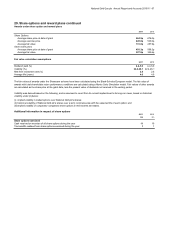

Deferred taxation comprises:

2011 2010

£m £m

A

ccelerated capital allowances 798 832

Other timing differences (22) (15)

776 817

There are no other significant unrecognised deferred tax assets or liabilities (2010: £nil).

Other provisions

The

p

rovision for emission costs is ex

p

ected to be settled usin

g

emission allowances

g

ranted or

p

urchased.

The environmental provision represents the net present value of the estimated statutory decontamination costs of old gas manufacturing sites

owned by the Company (discounted using a real rate of 2.0%). The anticipated timing of the cash flows for statutory decontamination cannot

be predicted with certainty, but they are expected to be incurred over the next 50 years.

At 31 March 2011, £26m of the total restructuring provision (2010: £26m) related to the restructuring of our Liquefied Natural Gas (LNG)

storage facilities, and £14m consisted of provisions for the disposal of surplus leasehold interests and rates payable on surplus properties

(2010: £5m). The expected payment dates for property restructuring costs remain uncertain. The remainder of the restructuring provision

related to business reorganisation costs, to be paid over the next two years.

A number of uncertainties affect the calculation of the provision for gas site decontamination, including the impact of regulation, the accuracy

of the site surveys, unexpected contaminants, transportation costs, the impact of alternative technologies and changes in the discount rate.

The provision incorporates our best estimate of the financial effect of these uncertainties, but future material changes in any of the

assumptions could materially impact on the calculation of the provision and hence the income statement.

The undiscounted amount of the provision at 31 March 2011 was £112m (2010: £110m), being the best undiscounted estimate of the liability

having regard to these uncertainties.

Other provisions at 31 March 2011 include £5m (2010: £6m) in respect of property transfer costs related to the sales of four UK gas

distribution networks and £22m (2010: £21m) in respect of employer liability claims. The payment dates for the property transfer costs are

uncertain, but should largely be over the next two years. In accordance with insurance industry practice, the estimates for employer liability

claims are based on experience from previous years and, therefore, there is no identifiable payment date associated with these items.

Deferred tax assets in respect of capital losses of £15m (2010: £15m) have not been recognised as their future recovery is uncertain or not

currently anticipated. The capital losses are available to carry forward indefinitely. The capital losses can be offset against specific types of

future capital gains.