National Grid 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.National Grid Gas plc Annual Report and Accounts 2010/11 29

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities, and when they relate to income taxes

levied by the same taxation authority and it is intended to settle

current tax assets and liabilities on a net basis.

H. Inventories

Inventories, which comprise raw materials and consumables,

are stated at cost less provision for damage and obsolescence.

Cost comprises cost of direct materials and those costs that

have been incurred in bringing the inventories to their present

location and condition.

I. Environmental costs

Provision is made for environmental costs arising from past

operations, based on future estimated expenditures, discounted

to present values. Changes in the provision arising from revised

estimates or discount rates or changes in the expected timing of

expenditures are recognised in the income statement. The

unwinding of the discount is included within the income

statement as a financing charge.

J. Revenue

Revenue represents the sales value derived from the

transmission and distribution of gas and the provision of gas

metering services during the year including assessment of the

value of services provided, but not invoiced at the year end. It

excludes value added tax and intra-group sales.

The sales value for the transmission and distribution of gas is

largely determined from the amount of system capacity sold for

the year and the amount of gas transported in the year,

evaluated at contractual prices on a monthly basis. Where

revenue for the year exceeds the maximum amount permitted

by regulatory agreement and adjustments will be made to future

prices to reflect this over-recovery, a liability for the over-

recovery is not recognised as such an adjustment to future

prices relates to the provision of future services. Similarly, an

asset is not recognised where a regulatory agreement permits

adjustments to be made to future prices in respect of an under-

recovery.

The sales value for the provision of gas metering services is

largely derived from monthly charges for the provision of

individual meters under contractual arrangements.

Income arising from the sale of properties as a result of property

management activities, from the sale of emission allowances

and from the recovery of pension deficit from other gas

transporters under regulatory arrangements is reported under

other operating income

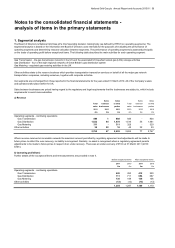

K. Segmental information

Segmental information is based on the information the Board of

Directors uses internally for the purposes of evaluating the

performance of operating segments and determining resource

allocation between operating segments. The Board of Directors

is deemed to be the chief operating decision-maker and

assesses the performance of operations principally on the basis

of operating items before exceptionals and remeasurements.

L. Pensions

The substantial majority of the Company’s employees are

members of the defined benefit section of the National Grid UK

Pension Scheme. There is no contractual arrangement or

stated policy for charging the net defined benefit cost of the

Scheme to the Company. Accordingly, the Scheme is

recognised as if it were a defined contribution scheme. The

pension charge for the year represents the contributions

payable to the Scheme for the period. A share of the assets and

liabilities, or the actuarial gains and losses of the Scheme are

not recognised in these financial statements.

M. Leases

Rentals under operating leases are charged to income on a

straight-line basis over the term of the relevant lease.

N. Financial instruments

Financial assets, liabilities and equity instruments are classified

according to the substance of the contractual arrangements

entered into, and recognised on trade date. Available-for-sale

financial assets are non-derivatives that are either designated in

this category or not classified in any other categories.

Trade receivables are initially recognised at fair value and

subsequently measured at amortised cost, less any appropriate

allowances for estimated irrecoverable amounts. A provision is

established for irrecoverable amounts when there is objective

evidence that amounts due under the original payment terms

will not be collected. Indications that the trade receivable may

become irrecoverable would include financial difficulties of the

debtor, likelihood of the debtor’s insolvency, and default or

significant failure of payment. Trade payables are initially

recognised at fair value and subsequently measured at

amortised cost.

Loans receivable and other receivables are carried at amortised

cost using the effective interest rate method. Interest income,

together with gains and losses when the loans and receivables

are derecognised or impaired, are recognised in the income

statement.

Other financial investments are recognised at fair value plus, in

the case of available-for-sale financial investments, directly

related incremental transaction costs and are subsequently

carried at fair value on the balance sheet. Changes in the fair

value of investments classified as fair value through profit and

loss are included in the income statement, while changes in the

fair value of investments classified as available-for-sale are

recognised directly in equity, until the investment is disposed of

or is determined to be impaired. At this time, the cumulative