National Grid 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2010/11 17

Cash flows

Cash flows from operating activities

Cash generated from continuing operations was £1,706 million

in 2010/11 compared with £1,872 million in 2009/10. This

included cash outflows relating to exceptional items of £72

million and £123 million respectively.

The net cash inflow from operating activities after taxation was

£1,588 million in 2010/11, compared with £1,563 million in

2009/10. This included a net corporate tax payment in 2010/11

of £118 million compared with £309 million in 2009/10.

Cash flows from investing activities

Cash outflows from investing activities were £919 million in

2010/11 compared with £266 million in 2009/10. Cash outflows

to purchase property, plant and equipment and intangible fixed

assets, net of disposal proceeds, were £1,005 million in

2010/11 compared with £952 million in 2009/10. Interest

received was £2 million in 2010/11 compared with £3 million in

2009/10. Net cash inflows from the disposal of financial

investments were £84 million in 2010/11 compared with £683

million in 2009/10.

Cash flows from financing activities

The net cash outflow from financing activities was £606 million

in 2010/11 compared with a cash outflow of £1,301 million in

2009/10. This reflected net inflows from loans of £58 million

(2009/10: £725 million outflow) and net payments to providers

of finance, in the form of interest and dividends, of £664 million

(2009/10: £576 million).

Net interest cash outflows decreased from £273 million in

2009/10 to £262 million in 2010/11.

Dividends paid to shareholders increased to £400 million in

2010/11 compared with £300 million in 2009/10.

Financial position and

financial management

Going concern

Having made enquiries, the Directors consider that the

Company and its subsidiaries have adequate resources to

continue in business for the foreseeable future and that it is

therefore appropriate to adopt the going concern basis in

preparing the consolidated and individual financial statements

of the Company. More details of our liquidity position are

provided under the heading Liquidity and treasury management

below and in note 28 to the consolidated financial statements.

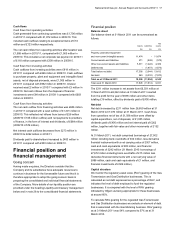

Financial position

Balance sheet

Our balance sheet at 31 March 2011 can be summarised as

follows:

Assets Liabilities

Net

assets

£m £m £m

Property, plant and equipment

and non-current intangible assets 11,474 -11,474

Current assets and liabilities 271 (849) (578)

Other non-current assets and liabilities 5,611 (1,222) 4,389

Deferred tax - (1,873) (1,873)

Total before net debt 17,356 (3,944) 13,412

Net debt 940 (8,010) (7,070)

Total as at 31 March 2011 18,296 (11,954) 6,342

Total as at 31 March 2010 17,845 (11,814) 6,031

The £311 million increase in net assets from £6,031 million at

31 March 2010 to £6,342 million at 31 March 2011 resulted

from the profit for the year of £695 million and other items

totalling £16 million, offset by dividends paid of £400 million.

Net debt

Net debt increased by £211 million from £6,859 million at 31

March 2010 to £7,070 million at 31 March 2011. Cash flows

from operations net of tax of £1,588 million were offset by

capital expenditure, net of disposals, of £1,005 million,

dividends paid of £400 million and net interest paid of £262

million, together with fair value and other movements of £132

million.

At 31 March 2011, net debt comprised borrowings of £7,902

million including bank overdrafts of £34 million, less derivative

financial instruments with a net carrying value of £507 million,

cash and cash equivalents of £83 million, and financial

investments of £242 million (31 March 2010: borrowings of

£7,672 million including bank overdrafts of £15 million less

derivative financial instruments with a net carrying value of

£486 million, cash and cash equivalents of £1 million, and

financial investments of £326 million).

Capital structure

We monitor the regulatory asset value (RAV) gearing of the Gas

Transmission and Gas Distribution businesses. This is

calculated as net debt expressed as a percentage of RAV, and

indicates the level of debt employed to fund the regulated

businesses. It is compared with the level of RAV gearing

indicated by Ofgem as being appropriate for these businesses,

at around 60%.

To calculate RAV gearing for the regulated Gas Transmission

and Gas Distribution businesses we exclude an element of debt

that is associated with the Gas Metering business. RAV gearing

as at 31 March 2011 was 54% compared to 57% as at 31

March 2010.