National Grid 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 National Grid Gas plc Annual Report and Accounts 2010/11

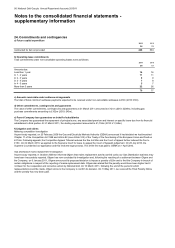

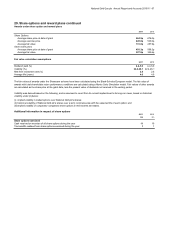

29. Share options and reward plans continued

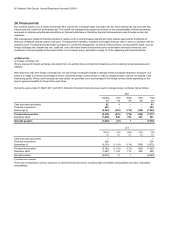

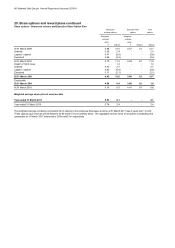

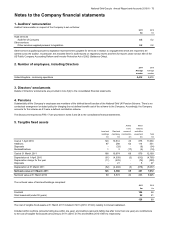

Share options - Sharesave scheme and Executive Share Option Plan

Sharesave Executive Plan Total

scheme options options options

Weighted Weighted

average average

price price

£ millions £ millions millions

A

t 31 March 2009 4.86 12.0 4.57 0.1 12.1

Granted 5.20 2.4 - - 2.4

Lapsed - expired 5.41 (0.6) - - (0.6)

Exercised 3.96 (2.4) - - (2.4)

A

t 31 March 2010 5.10 11.4 4.59 0.1 11.5

Impact of rights issue - 1.4 - - 1.4

Granted 4.45 2.7 - - 2.7

Lapsed - expired 4.63 (0.8) - - (0.8)

Exercised 5.11 (2.1) - - (2.1)

At 31 March 2011 4.43 12.6 3.80 0.1 12.7

Exercisable

At 31 March 2011 4.84 0.9 3.80 0.1 1.0

A

t 31 March 2010 5.15 0.5 4.41 0.1 0.6

Weighted average share price at exercise date

Year ended 31 March 2011 5.53 2.1 - - 2.1

Year ended 31 March 2010 5.74 2.4 - - 2.4

The weighted average remaining contractual life of options in the employee Sharesave scheme at 31 March 2011 was 2 years and 1 month.

These options have exercise prices between £3.80 and £5.73 per ordinary share. The aggregate intrinsic value of all options outstanding and

exercisable at 31 March 2011 amounted to £54m and £1m respectively.