National Grid 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Gas plc Annual Report and Accounts 2010/11 15

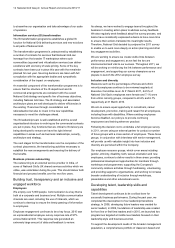

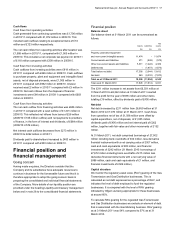

Reconciliation of operating profit to profit and earnings

Years ended 31 March

2011 2010

£m £m

Operating profit 1,189 1,110

Net finance costs (394) (221)

Total profit before taxation 795 889

Taxation (100) (288)

Profit 695 601

Attributable to non-controlling interests (1) (1)

Earnings 694 600

Reconciliation of adjusted operating profit to total

operating profit

Years ended 31 March

2011 2010

Continuing operations £m £m

Adjusted operating profit 1,254 1,297

Exceptional items (65) (187)

Total operating profit 1,189 1,110

Reconciliation of adjusted profit before taxation to total

profit before taxation

Years ended 31 March

2011 2010

Continuing operations £m £m

Adjusted profit before taxation 884 1,043

Exceptional items (96) (187)

Remeasurements 7 33

Total profit before taxation 795 889

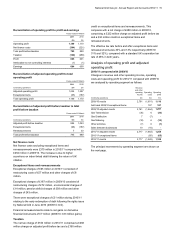

Net finance costs

Net finance costs excluding exceptional items and

remeasurements were £370 million in 2010/11 compared with

£254 million in 2009/10. The increase is due to higher

accretions on index-linked debt following the return of UK

inflation.

Exceptional items and remeasurements

Exceptional charges of £65 million in 2010/11 consisted of

restructuring costs of £57 million and other charges of £8

million.

Exceptional charges of £187 million in 2009/10 consisted of

restructuring charges of £72 million, environmental charges of

£14 million, pension deficit charges of £58 million and other

charges of £43 million.

There were exceptional charges of £31 million during 2010/11

relating to the early redemption of debt following the rights issue

by National Grid in June 2010 (2009/10: £nil).

Financial remeasurements relate to net gains on derivative

financial instruments of £7 million (2009/10: £33 million gains).

Taxation

The net tax charge of £100 million in 2010/11 comprised a £268

million charge on adjusted profit before tax and a £168 million

credit on exceptional items and remeasurements. This

compares with a net charge of £288 million in 2009/10,

comprising a £322 million charge on adjusted profit before tax

and a £34 million credit on exceptional items and

remeasurements.

The effective tax rate before and after exceptional items and

remeasurements was 30% and 13% respectively (2009/10:

31% and 32%), compared with a standard UK corporation tax

rate of 28% in both years.

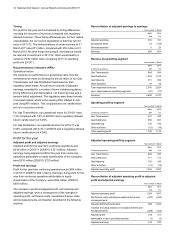

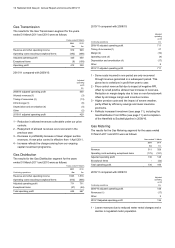

Analysis of operating profit and adjusted

operating profit

2010/11 compared with 2009/10

Changes in revenue and other operating income, operating

costs and operating profit for 2010/11 compared with 2009/10

are analysed by operating segment as follows:

Revenue

and other

operating

income

Operating

costs

Operating

profit

Continuing operations £m £m £m

2009/10 results 2,761 (1,651) 1,110

Add back 2009/10 exceptional items - 187 187

2009/10 adjusted results 2,761 (1,464) 1,297

Gas Transmission (36) 6 (30)

Gas Distribution 7 (7) -

Gas Metering (18) 6 (12)

Other activities (7) 6 (1)

Sales between businesses 10 (10) -

2010/11 adjusted results 2,717 (1,463) 1,254

2010/11 exceptional items - (65) (65)

2010/11 results 2,717 (1,528) 1,189

The principal movements by operating segment are shown on

the next page.