National Grid 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 National Grid Gas plc Annual Report and Accounts 2010/11

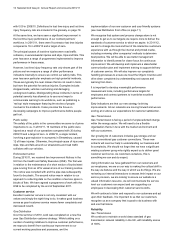

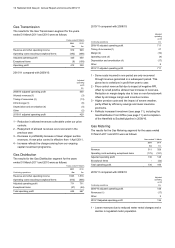

For debt and derivative instruments held, we utilise a sensitivity

analysis technique to evaluate the effect that changes in

relevant rates or prices would have on the market value of such

instruments.

As described in note 28(e) to the consolidated financial

statements, movements in financial indices would have the

following estimated impact on the financial statements as a

consequence of changes in the value of financial instruments.

Years ended 31 March 2011 2010

Income

statement

£m

Othe

r

compre-

hensive

income

£m

Income

statement

£m

Othe

r

compre-

hensive

income

£m

UK Retail Prices Index ± 0.50% 12 - 10 -

UK interest rates ± 0.50% 7 13 516

Commodity contracts

Gas purchased for our own use relates to the operation of our

gas transmission and gas distribution networks. Contracts are

accounted for as ordinary purchase contracts.

In our gas transmission operations, we are obliged to offer for

sale through a series of auctions, both short- and long-term, a

predetermined quantity of entry capacity for every day in the

year at pre-defined locations. Where, on the day, the gas

transmission system’s capability is constrained, such that gas is

prevented from entering the system for which entry capacity

rights have been sold, then UK gas transmission is required to

buy back those entry capacity rights sold in excess of system

capability. Forward and option contracts may be used to reduce

the risk and exposure to on the day entry capacity prices.

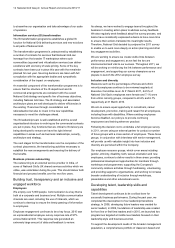

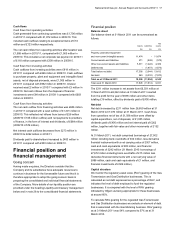

Commitments and contingencies

Commitments and contingencies outstanding at 31 March 2011

and 2010 are summarised in the table below:

2011 2010

£m £m

Future capital expenditure contracted but not

provided for 428 533

Total operating lease commitments 70 77

Other commitments and contingencies 19 26

Information regarding obligations under pension and other post-

retirement benefits is given below under the heading

‘Retirement arrangements’.

We propose to meet all of our commitments from existing cash

and investments, operating cash flows, existing credit facilities,

future facilities and other financing that we reasonably expect to

be able to secure in the future.

Details of material litigation as at 31 March 2011

We were not party to litigation that we considered to be material

as at 31 March 2011. Save as set out below, there have been

no governmental, legal or arbitration proceedings in the last 12

months which may have or have had significant effects on the

Company’s financial position or profitability.

Metering competition investigation

As previously reported, on 25 February 2008 the Gas and

Electricity Markets Authority (GEMA) announced it had decided

we had breached Chapter II of the Competition Act 1998 and

Article 82 (now Article 102) of the Treaty of the Functioning of

the European Union and fined us £41.6 million. Following

appeals, the Competition Appeal Tribunal reduced the fine to

£30 million and the Court of Appeal further reduced the fine to

£15 million. On 22 March 2010, we applied to the Supreme

Court for leave to appeal the Court of Appeal’s judgement. On

28 July 2010, the Supreme Court denied our application and

this ends the legal process. The £15 million fine was paid to

GEMA on 1 April 2010.

Gas distribution mains replacement investigation

As previously reported, in October 2008 we informed Ofgem

that mains replacement activity carried out by the Gas

Distribution business may have been inaccurately reported.

Ofgem has now concluded its investigation and, following the

reaching of a settlement between Ofgem and the Company, on

6 January 2011 Ofgem announced its intention to impose a

penalty of £8 million and to find the Company in breach of

certain obligations in respect of the reporting of mains

replacement data. Ofgem also stated that the penalty would

have been higher had it not been for the cooperation and

corrective action by the Company. On 10 March 2011, following

the end of the period in which representations could be made in

respect of the proposed decision, Ofgem wrote to us to confirm

its decision. On 13 May 2011, we received the Final Penalty

Notice the penalty has now been paid.

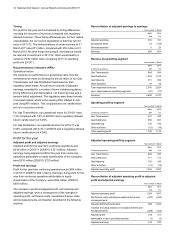

Related party transactions

We provide services to and receive services from related

parties, principally fellow subsidiary companies of National Grid.

In the year ended 31 March 2011, National Grid Gas charged

£20 million and received charges of £76 million from related

parties (other than Directors and key managers), compared with

£21 million and £139 million respectively in 2009/10.

Further information relating to related party transactions is

contained within note 25 to the consolidated financial

statements. Details of key management compensation and

amounts paid to Directors are included within notes 3(c) and

3(d) to the consolidated financial statements respectively.

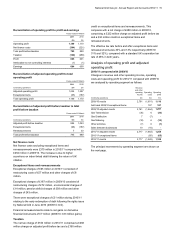

Retirement arrangements

The substantial majority of our employees are members of the

National Grid UK Pension Scheme, which is operated by Lattice

Group plc, an intermediate holding company of National Grid

Gas. We do not provide any other post-retirement benefits. The

scheme has both a defined benefit section, which is closed to

new entrants, and a defined contribution section, which is

offered to all new employees.

In September 2010 the UK government changed the basis for

statutory pension increases from the retail price index (RPI) to

the consumer price index (CPI). The scheme rules of our

pension scheme specifically reference RPI. As a consequence,