NVIDIA 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

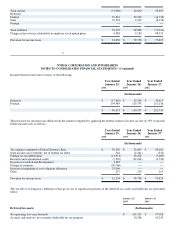

Long term portion $ 856

Rent expense for the years ended January 25, 2004, January 26, 2003 and January 27, 2002 was approximately $26.4 million, $25.6

million and $13.8 million, respectively.

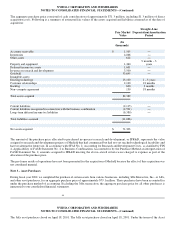

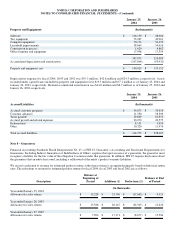

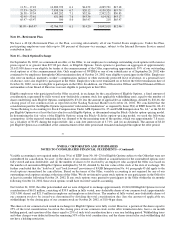

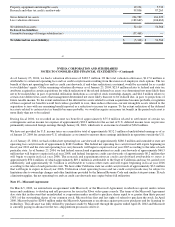

The following is an analysis of the property and equipment under capital leases by major classes:

January 25, January 26,

2004 2003

Classes of Property and Equipment: (In thousands)

Computer equipment $ 4,331 $ 4,347

Test equipment 9,309 6,895

Office equipment and furniture 5,232 5,261

Software and other 634 634

19,506 17,137

Accumulated amortization (14,016) (8,683)

Leased property and equipment, net $ 5,490 $ 8,454

60

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

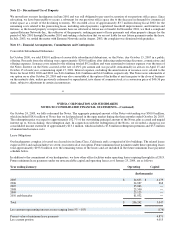

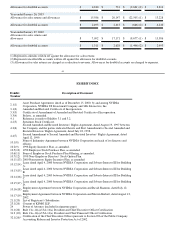

Litigation

On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an agreement to purchase certain

graphics chip assets from 3dfx. The asset purchase closed on April 18, 2001. In May 2002, we were served with a complaint filed by

the landlord of 3dfx’s San Jose, California commercial real estate lease. In October 2002, 3dfx filed for Chapter 11 bankruptcy

protection in the United States Bankruptcy Court for the Northern District of California. In December 2002, we were served with a

complaint filed by the landlord of 3dfx’s Austin, Texas commercial real estate lease. The landlords’ complaints both assert claims for,

among other things, interference with contract, successor liability and fraudulent transfer. The landlords’ are seeking to recover,

among other things, amounts owed on their leases in the aggregate amount of approximately $10 million. In March 2003, we were

served with a complaint filed by the Trustee appointed by the Bankruptcy Court to represent the interests of the 3dfx bankruptcy

estate. The Trustee’s complaint asserts claims for, among other things, successor liability and fraudulent transfer. The Trustee’s

complaint seeks additional payments from us, the amount of which has not been quantified. The landlords’ actions have been removed

to the Bankruptcy Court from the Superior Court of California and consolidated with the Trustee’s action for purposes of discovery.

Discovery is currently proceeding and no trial date has been set. We believe the claims asserted against us are without merit and we

will continue to defend ourselves vigorously.

We are subject to other legal proceedings, but we do not believe that the ultimate outcome of any of these proceedings will have a

material adverse effect on our financial position or overall trends in results of operations. However, if an unfavorable ruling were to

occur in any specific period, there exists the possibility of a material adverse impact on the results of operations of that period.

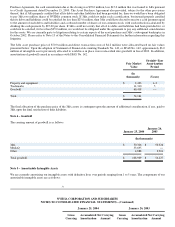

Note 14 – Income Taxes

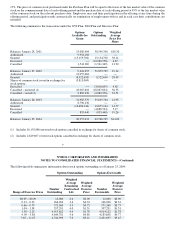

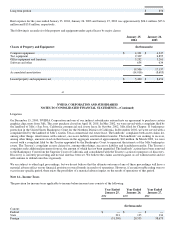

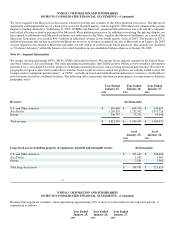

The provision for income taxes applicable to income before income taxes consists of the following:

Year Ended Year Ended Year Ended

January 25, January 26, January 27,

2004 2003 2002

(In thousands)

Current:

Federal $ −− $ −− $ −−

State 221 135 134

Foreign (51,590) 20,555 38,673