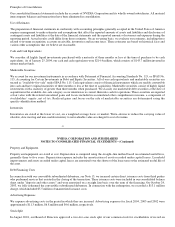

NVIDIA 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

· suppliers of MCPs that incorporate 3D graphics functionality as part of their existing solutions, such as ATI, Intel, Silicon Integrated

Systems and VIA;

· suppliers of desktop standalone GPUs that incorporate 3D graphics functionality as part of their existing solutions, such as ATI,

Creative Technology, Matrox Electronics Systems Ltd. and XGI Technology, Inc.,;

· suppliers of notebook standalone GPUs that incorporate 3D graphics functionality as part of their existing solutions, such as ATI,

Silicon Motion. and the joint venture of a division of SONICblue Incorporated (formerly S3 Incorporated) and VIA; and

· suppliers of UMPs for handheld devices that incorporate advanced graphics functionality as part of their existing solutions, such as

ATI and Seiko−Epson.

If and to the extent we offer products outside of the personal computer, consumer electronics and handheld segments, we may face

competition from some of our existing competitors as well as from companies with which we currently do not compete. We cannot

accurately predict if we will compete successfully in any new markets we may enter.

Our failure to achieve one or more design wins would harm our business.

Our future success will depend in large part on achieving design wins, which entails having our existing and future products chosen

for hardware components or subassemblies designed by PC OEMs, ODMs, and add−in board and motherboard manufacturers. Our

add−in board and motherboard manufacturers and major OEM and ODM customers typically introduce new system configurations as

often as twice per year, generally based on spring and fall design cycles. Accordingly, our existing products must have competitive

performance levels or we must timely introduce new products with such performance characteristics in order to be included in new

system configurations. Our failure to achieve one or more design wins would harm our business. The process of being qualified for

inclusion in an OEM’s product can be lengthy and could cause us to miss a cycle in the demand of end users for a particular product

feature, which also could harm our business.

Our ability to achieve design wins also depends in part on our ability to identify and ensure compliance with evolving industry

standards. Unanticipated changes in industry standards could render our products incompatible with products developed by major

hardware manufacturers and software developers, including Intel and Microsoft. This would require us to invest significant time and

resources to redesign our products to ensure compliance with relevant standards. If our products are not in compliance with prevailing

industry standards for a significant period of time, our ability to achieve design wins could suffer.

Risks Related to Market Conditions

We are subject to risks associated with international operations which may harm our business.

Our reliance on foreign third−party manufacturing, assembly, testing and packaging operations subjects us to a number of risks

associated with conducting business outside of the United States, including the following:

· unexpected changes in, or impositions of, legislative or regulatory requirements;

· delays resulting from difficulty in obtaining export licenses for certain technology, tariffs, quotas and other trade barriers and

restrictions;

· longer payment cycles;

· imposition of additional taxes and penalties;

· the burdens of complying with a variety of foreign laws; and

· other factors beyond our control, including terrorism and war, which may delay the shipment of our products.

31

We also are subject to general political risks in connection with our international trade relationships. In addition, the laws of certain

foreign countries in which our products are or may be manufactured or sold, including various countries in Asia, may not protect our

products or intellectual property rights to the same extent as do the laws of the United States. This makes the possibility of piracy of

our technology and products more likely.

Currently, all of our arrangements with third−party manufacturers provide for pricing and payment in U.S. dollars, and to date we

have not engaged in any currency hedging activities, although we may do so in the future. Fluctuations in currency exchange rates

could harm our business in the future.

Our business is cyclical in nature and an industry downturn could harm our business.

Our business is directly affected by market conditions in the highly cyclical semiconductor industry, including alternating periods of

overcapacity and capacity constraints, variations in manufacturing costs and yields, significant expenditures for capital equipment and

product development and rapid technological change. If we are unable to respond to changes in our industry, which can be

unpredictable and rapid, in an efficient and timely manner, our operating results could suffer. In particular, from time to time, the