NVIDIA 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million acquisition of MediaQ in August 2003. Our portfolio of cash equivalents and marketable securities is managed by several

financial institutions. Our investment policy requires the purchase of top−tier investment grade securities, the diversification of asset

type and certain limits on our portfolio duration.

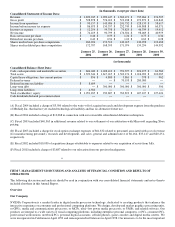

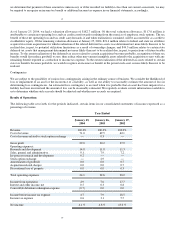

Operating activities generated cash of $49.7 million, $265.0 million and $160.8 million during fiscal 2004, 2003 and 2002,

respectively. The decrease in cash flows from operating activities in fiscal 2004 when compared to fiscal 2003 was primarily due to

the increase in inventory and decrease in income taxes payable due to the settlement of certain tax contingencies.

Cash used in investing activities has consisted primarily of investments in marketable securities, the purchase of certain assets from

various businesses and purchases of property and equipment, which include leasehold improvements for our facilities. Investing

activities provided cash of $88.0 million and used cash of $277.3 million during fiscal 2004 and 2003, respectively. Net cash provided

by investing activities in fiscal 2004 was primarily due to $286.9 million of net sales and maturities of marketable securities as we

liquidated a significant portion of our marketable securities portfolio in order to obtain the cash required to redeem the $300.0 million

Notes in October 2003. This increase in cash from sales and maturities of marketable securities was offset by $127.6 million in capital

expenditures primarily attributable to purchases of new research and development emulation equipment, technology licenses and

software and $71.3 million for the acquisition of MediaQ. We expect to spend approximately $80.0 million to $100.0 million for

capital expenditures during fiscal 2005, primarily for software licenses, emulation equipment, computer and engineering workstations.

In addition, we may continue to use cash in connection with the acquisition of new businesses or assets.

Financing activities used cash of $270.3 million during fiscal 2004 compared to cash provided of $26.3 million in fiscal 2003. The

increase in cash used in fiscal 2004 when compared to fiscal 2003 was primarily due to the $300.0 million redemption of the Notes,

which included $18.6 million of Notes that we had purchased during the three months ended October 26, 2003.

20

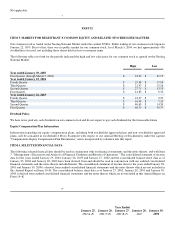

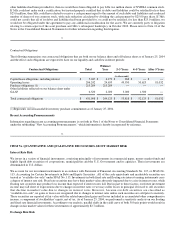

Operating Capital and Capital Expenditure Requirements

We believe that our existing cash balances and anticipated cash flows from operations will be sufficient to meet our operating,

acquisition and capital requirements for at least the next 12 months. However, there is no assurance that we will not need to raise

additional equity or debt financing within this time frame. Additional financing may not be available on favorable terms or at all and

may be dilutive to our then−current stockholders. We also may require additional capital for other purposes not presently

contemplated. If we are unable to obtain sufficient capital, we could be required to curtail capital equipment purchases or research and

development expenditures, which could harm our business. Factors that could affect our cash used or generated from operations and,

as a result, our need to seek additional borrowings or capital include:

· decreased demand and market acceptance for our products and/or our customers’ products;

· inability to successfully develop and produce in volume production our next−generation products;

· competitive pressures resulting in lower than expected average selling prices; and

· new product announcements or product introductions by our competitors.

For additional factors see "Business Risks – Our operating results are unpredictable and may fluctuate, and if our operating results are

below the expectations of securities analysts or investors, our stock price could decline."

Other key factors that could affect our liquidity include:

Shelf Registration Statement

In December 2003, we filed a Form S−3 with the Securities and Exchange Commission, or SEC, under their "shelf" registration

process. This shelf registration was declared effective by the SEC on March 25, 2004. Under this shelf registration process, we may

sell common stock, preferred stock, debt securities, warrants, stock purchase contracts and/or stock purchase units in one or more

offerings up to a total dollar amount of $500.0 million. Unless otherwise indicated in the applicable prospectus supplement, we intend

to use the proceeds for working capital and general corporate purposes. In particular, we expect to incur significant operating expenses

in connection with:

· continuing to develop our technology;

· hiring additional personnel;

· expanding our sales and marketing organization and activities;

· acquiring complementary technologies or businesses; and

· capital expenditures

3dfx Asset Purchase

The 3dfx asset purchase closed on April 18, 2001. Under the terms of the Asset Purchase Agreement, the cash consideration due at the

closing was $70.0 million, less $15.0 million that was loaned to 3dfx pursuant to a Credit Agreement dated December 15, 2000. The

Asset Purchase Agreement also provided, subject to the other provisions thereof, that if 3dfx properly certified that all its debts and