NVIDIA 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

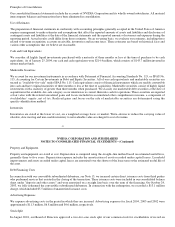

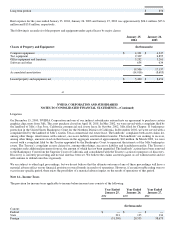

Purchase Agreement, the cash consideration due at the closing was $70.0 million, less $15.0 million that was loaned to 3dfx pursuant

to a Credit Agreement dated December 15, 2000. The Asset Purchase Agreement also provided, subject to the other provisions

thereof, that if 3dfx properly certified that all its debts and other liabilities had been provided for, then we would have been obligated

to pay 3dfx two million shares of NVIDIA common stock. If 3dfx could not make such a certification, but instead properly certified

that its debts and liabilities could be satisfied for less than $25.0 million, then 3dfx could have elected to receive a cash payment equal

to the amount of such debts and liabilities and a reduced number of shares of our common stock, with such reduction calculated by

dividing the cash payment by $25.00 per share. If 3dfx could not certify that all of its debts and liabilities had been provided for, or

could not be satisfied, for less than $25.0 million, we would not be obligated under the agreement to pay any additional consideration

for the assets. We are currently party to litigation relating to certain aspects of the asset purchase and 3dfx’s subsequent bankruptcy in

October 2002. Please refer to Note 13 of the Notes to the Consolidated Financial Statements for further information regarding this

litigation.

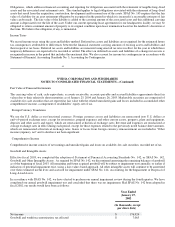

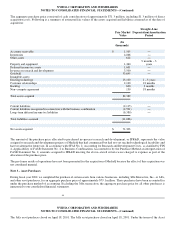

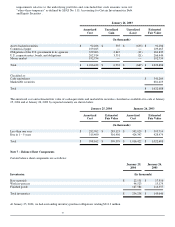

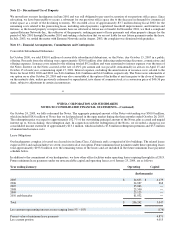

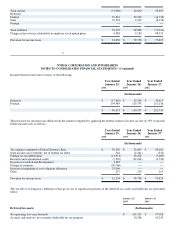

The 3dfx asset purchase price of $70.0 million and direct transaction costs of $4.2 million were allocated based on fair values

presented below. Upon the adoption of Statement of Financial Accounting Standards No. 142, or SFAS No. 142, approximately $3.0

million of intangible assets previously allocated to workforce in place were reclassified into goodwill in fiscal 2003. In addition,

amortization of goodwill ceased in accordance with SFAS No. 142.

Fair Market

Value

Straight−Line

Amortization

Period

(In

thousands) (Years)

Property and equipment $ 2,433 1−2

Trademarks 11,310 5

Goodwill 60,418 −−

Total $ 74,161

The final allocation of the purchase price of the 3dfx assets is contingent upon the amount of additional consideration, if any, paid to

3dfx upon the final satisfaction of their liabilities.

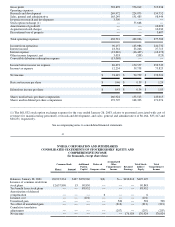

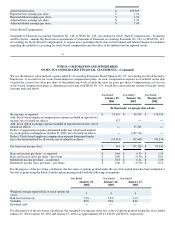

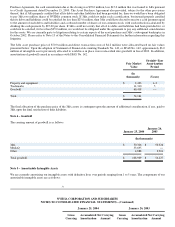

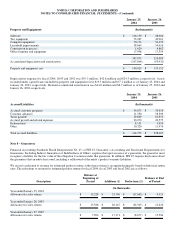

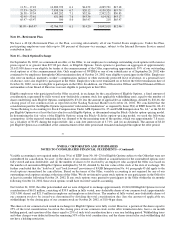

Note 4 – Goodwill

The carrying amount of goodwill is as follows:

January 25, 2004 January 26,

2003

(In thousands)

3dfx $ 50,326 $ 50,326

MediaQ 53,695 −−

Other 4,888 3,901

Total goodwill $ 108,909 $ 54,227

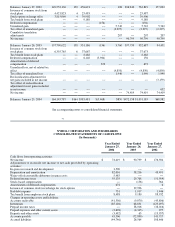

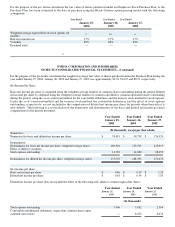

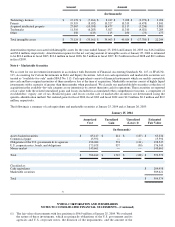

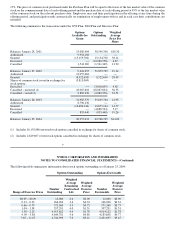

Note 5 – Amortizable Intangible Assets

We are currently amortizing our intangible assets with definitive lives over periods ranging from 1 to 5 years. The components of our

amortizable intangible assets are as follows:

51

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 25, 2004 January 26, 2003

Gross

Carrying Accumulated

Amortization Net Carrying

Amount Gross

Carrying Accumulated

Amortization Net Carrying

Amount