NVIDIA 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

well as other expenses during the year.

17

We anticipate that we will continue to devote substantial resources to research and development, and we expect these expenses to

increase in absolute dollars in the foreseeable future due to the increased complexity and the greater number of products under

development. Research and development expenses are likely to fluctuate from time to time to the extent we make periodic incremental

investments in research and development and these investments may be independent of our level of revenues.

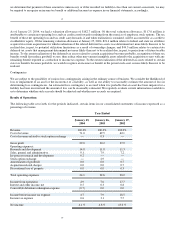

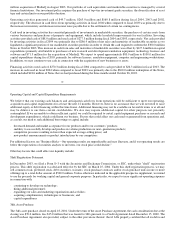

Sales, General and Administrative. Sales, general and administrative expenses consist primarily of salaries, commissions and bonuses,

promotional tradeshow and advertising expenses, travel and entertainment expenses and legal and accounting expenses. Sales, general

and administrative expenses increased $13.8 million, or 9%, from fiscal 2003 to fiscal 2004 primarily due to a $12.9 million increase

related to additional personnel, a $9.1 million increase in tradeshow, marketing development and general administrative activities and

a $3.2 million increase in computer software and equipment related to the enhancement of our computer systems and the depreciation

and amortization of new equipment. These increases were offset by an $11.4 million decrease in legal fees related to higher legal fees

incurred during fiscal 2003 for various issues that have since been resolved, including the SEC inquiry, Microsoft arbitration and

shareholder lawsuits. Sales, general and administrative expenses increased $52.5 million, or 53%, from fiscal 2002 to 2003 primarily

due to a $16.4 million increase related to additional personnel and commissions, a $16.6 million increase in legal and accounting

expenses associated with various legal proceedings, a $9.0 million increase in equipment and software primarily related to the

enhancement of our computer systems, a $7.9 million increase in tradeshow and product launch costs, and a $2.6 million increase in

facilities costs due to the move into a new building at our headquarters and a full year of occupation in all headquarter buildings as

well as other increases associated with general administrative activities and travel and entertainment expenses.

We expect sales, general and administrative expenses to continue to increase in absolute dollars as we continue to support our

operations, expand our sales, launch our new products and protect our business interests.

In−process research and development. In connection with our acquisition of MediaQ in August 2003, we wrote−off $3.5 million of

in−process research and development expense, or IPR&D, that had not yet reached technological feasibility and has no alternative

future use. In accordance with SFAS No. 2, Accounting for Research and Development Costs , as clarified by FIN 4, Applicability of

SFAS No. 2 to Business Combinations Accounted for by the Purchase Method an interpretation of SFAS No. 2 , amounts assigned to

IPR&D meeting the above−stated criteria must be charged to expense as part of the allocation of the purchase price.

Stock Option Exchange. On September 26, 2002, we commenced an offer, or the Offer, to our employees to exchange outstanding

stock options with exercise prices equal to or greater than $27.00 per share, or Eligible Options. Stock options to purchase an

aggregate of approximately 20,615,000 shares were eligible for tender at the commencement of the Offer, representing approximately

39% of our outstanding stock options as of the commencement date. Only employees of NVIDIA or one of our subsidiaries as of

September 26, 2002 who continued to be employees through the Offer termination date of October 24, 2002 were eligible to

participate in the Offer. Employees who were on medical, maternity, worker’s compensation, military or other statutorily protected

leave of absence, or a personal leave of absence, were also eligible to participate in the Offer. Employees who were terminated on or

before the Offer termination date of October 24, 2002, were not eligible to participate in the Offer. In addition, our Chief Executive

Officer and Chief Financial Officer and members of our Board of Directors were not eligible to participate in this Offer.

On October 24, 2002, the offer period ended and we were obligated to exchange approximately 18,843,000 Eligible Options for total

consideration of $61.8 million, consisting of $39.9 million in fully vested, non−forfeitable shares of our common stock (approximately

3,815,000 shares) and $21.9 million in employer and employee related taxes. The number of fully vested, non−forfeitable shares of

our common stock to be issued was determined by dividing the total consideration due (less the amount of applicable tax

withholdings) by the closing price of our common stock on October 24, 2002, of $10.46 per share.

18

Amortization of Goodwill. During fiscal 2002, amortization of goodwill was associated with goodwill from the asset purchase from

3dfx. The initial allocation of the purchase price included $57.4 million of goodwill, plus approximately $3.0 million of intangible

assets previously allocated to workforce in place, which was reclassified into goodwill as of the beginning of fiscal 2003.

In accordance with SFAS No. 142, Goodwill and Other Intangible Assets , we no longer amortize goodwill as of the beginning of

fiscal 2003. We have elected to perform our annual impairment review during the fourth quarter of each fiscal year. We completed our

annual goodwill impairment test for fiscal 2004 and concluded that there was no impairment.

Acquisition Related Charges. Acquisition related charges are attributable to expenses related to the acquisition of assets from 3dfx in

fiscal 2002. These charges primarily consisted of bonuses to former 3dfx employees.

Discontinued Use of Property. Discontinued use of property consists of write−offs of $3.7 million relating to our previous office space

in Santa Clara, California. Since we relocated in June 2001, we have been unable to secure a subtenant for our previous office space