NVIDIA 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

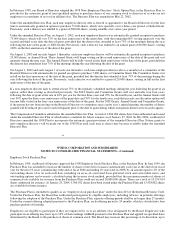

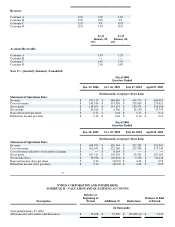

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

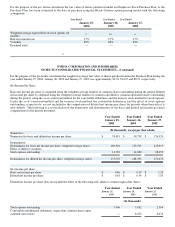

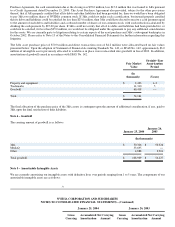

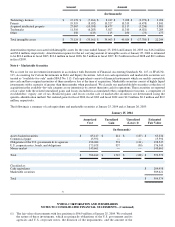

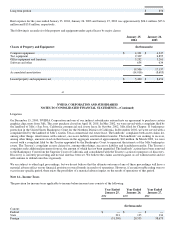

January 25, January 26,

2004 2003

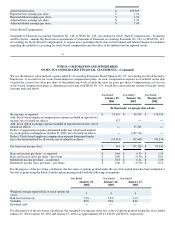

Property and Equipment: (In thousands)

Software $ 116,150 $ 48,006

Test equipment 73,287 49,961

Computer equipment 70,173 54,479

Leasehold improvements 58,649 54,416

Construction in process 1,620 4,862

Office furniture and equipment 17,996 17,359

337,875 229,083

Accumulated depreciation and amortization (147,846) (93,931)

Property and equipment, net $ 190,029 $ 135,152

Depreciation expense for fiscal 2004, 2003 and 2002 was $59.3 million, $42.6 million and $24.3 million, respectively. Assets

recorded under capital leases included in property and equipment were $19.5 million and $17.1 million as of January 25, 2004 and

January 26, 2003, respectively. Related accumulated amortization was $14.0 million and $8.7 million as of January 25, 2004 and

January 26, 2003, respectively.

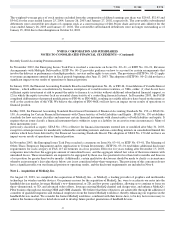

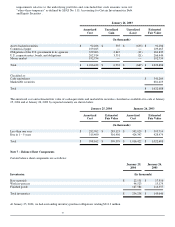

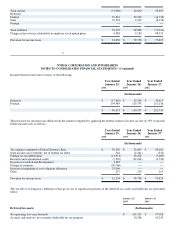

January 25, January 26,

2004 2003

Accrued Liabilities: (In thousands)

Accrued customer programs $ 54,875 $ 50,018

Customer advances 11,530 58,396

Taxes payable 29,609 82,952

Accrued payroll and related expenses 30,270 20,575

Deferred rent 8,151 5,050

Other 10,320 11,476

Total accrued liabilities $ 144,755 $ 228,467

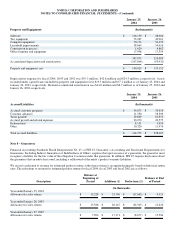

Note 8 – Guarantees

Financial Accounting Standards Board Interpretation No. 45, or FIN 45, Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of Others, requires that upon issuance of a guarantee, the guarantor must

recognize a liability for the fair value of the obligation it assumes under that guarantee. In addition, FIN 45 requires disclosures about

the guarantees that an entity has issued, including a rollforward of the entity’s product warranty liabilities.

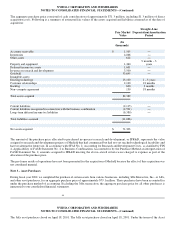

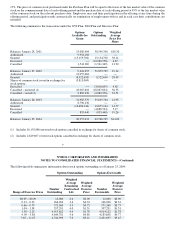

We record a reduction to revenue for estimated product returns at the time revenue is recognized primarily based on historical return

rates. The reductions to revenue for estimated product returns for fiscal 2004, fiscal 2003 and fiscal 2002 are as follows:

Description

Balance at

Beginning of

Period Additions (1) Deductions (2) Balance at End

of Period

(In thousands)

Year ended January 25, 2004

Allowance for sales returns $ 13,228 $ 23,796 $ (27,603) $ 9,421

Year ended January 26, 2003

Allowance for sales returns $ 15,586 $ 20,147 $ (22,505) $ 13,228

Year ended January 27, 2002

Allowance for sales returns $ 7,092 $ 17,171 $ (8,677) $ 15,586