NVIDIA 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

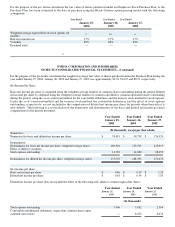

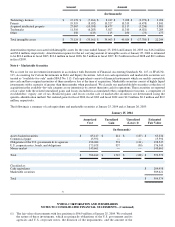

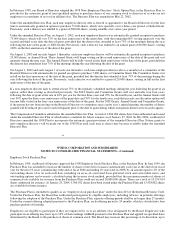

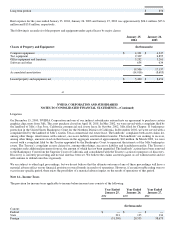

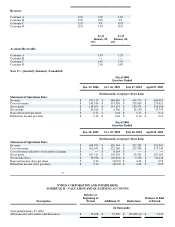

11.51 – 17.18 14,880,723 6.1 $14.52 4,265,731 $15.18

17.53 – 26.25 7,838,336 6.7 $20.12 4,130,320 $19.79

26.38 – 39.54 4,003,202 7.1 $32.36 2,392,121 $30.83

42.98 – 53.61 631,000 7.6 $43.36 614,562 $43.17

65.47 – 65.47 500 8.0 $65.47 218 $65.47

$0.09 − $65.47 42,766,705 6.1 $14.20 24,042,018 $12.46

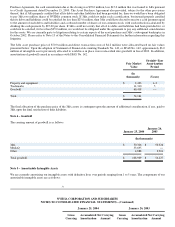

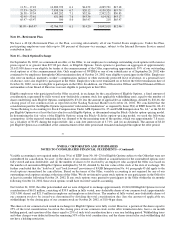

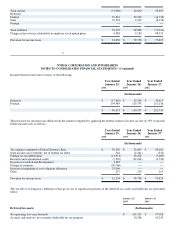

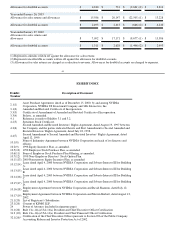

Note 10 – Retirement Plan

We have a 401(k) Retirement Plan, or the Plan, covering substantially all of our United States employees. Under the Plan,

participating employees may defer up to 100 percent of their pre−tax earnings, subject to the Internal Revenue Service annual

contribution limits.

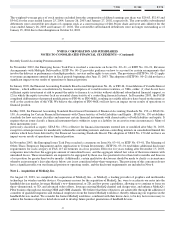

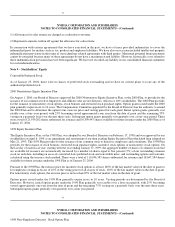

Note 11 – Stock Option Exchange

On September 26, 2002, we commenced an offer, or the Offer, to our employees to exchange outstanding stock options with exercise

prices equal to or greater than $27.00 per share, or Eligible Options. Stock options to purchase an aggregate of approximately

20,615,000 shares were eligible for tender at the commencement of the Offer, representing approximately 39% of our outstanding

stock options as of the commencement date. Only employees of NVIDIA or one of our subsidiaries as of September 26, 2002 who

continued to be employees through the Offer termination date of October 24, 2002 were eligible to participate in the Offer. Employees

who were on medical, maternity, worker’s compensation, military or other statutorily protected leave of absence, or a personal leave

of absence, were also eligible to participate in the Offer. Employees who were terminated on or before the Offer termination date of

October 24, 2002, were not eligible to participate in the Offer. In addition, our Chief Executive Officer and Chief Financial Officer

and members of our Board of Directors were not eligible to participate in this Offer.

Eligible employees who participated in the Offer received, in exchange for the cancellation of Eligible Options, a fixed amount of

consideration, represented by fully vested, non−forfeitable common stock less applicable withholding taxes, equal to the number of

shares underlying such Eligible Options, multiplied by $3.20, less the amount of applicable tax withholdings, divided by $10.46, the

closing price of our common stock as reported on the Nasdaq National Market on October 24, 2002. We concluded that the

consideration paid for the Eligible Options represented "substantial consideration" as required by Issue 39(f) of EITF Issue No. 00−23

"Issues Relating to Accounting for Stock Compensation Under APB Opinion No. 25 and FASB Interpretation No. 44," as the $3.20

per Eligible Option was at least the fair value for each Eligible Option, as determined using the Black−Scholes option−pricing model.

In determining the fair value of the Eligible Options using the Black−Scholes option−pricing model, we used the following

assumptions: (i) the expected remaining life was deemed to be the remaining term of the options, which was approximately 7.8 years;

(ii) a volatility of 50.0% during the expected life; (iii) a risk−free interest rate of 3.71%; and (iv) no dividends. The amount of $3.20

per Eligible Option was established at the commencement of the offer period and remained unchanged throughout the offer period.

58

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

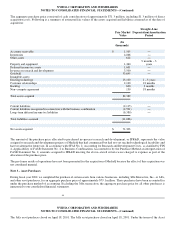

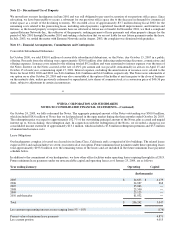

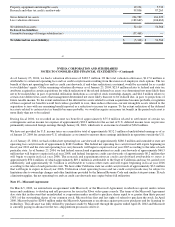

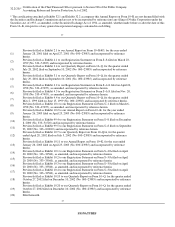

Variable accounting is not required under Issue 39(a) of EITF Issue No. 00−23 for Eligible Options subject to the Offer that were not

surrendered for cancellation, because: (i) the shares of our common stock offered as consideration for the surrendered options were

fully vested and non−forfeitable; and (ii) the number of shares to be received by an employee who accepted the Offer was based on

the number of surrendered Eligible Options multiplied by $3.20, divided by the fair value of the stock at the date of exchange. We

further concluded that the "look back" and "look forward" provisions of FASB Interpretation No. 44, paragraph 45 did apply to the

stock options surrendered for cancellation. Based on the terms of the Offer, variable accounting is not required for any of our

outstanding stock options existing at the time of the Offer. We do not intend to grant stock options to any participants in the Offer for

at least six months following October 24, 2002. If any stock options were granted to participants in the Offer within the six months

following October 24, 2002, those stock options would have received variable accounting.

On October 24, 2002, the offer period ended and we were obligated to exchange approximately 18,843,000 Eligible Options for total

consideration of $61.8 million, consisting of $39.9 million in fully vested, non−forfeitable shares of our common stock (approximately

3,815,000 shares) and $21.9 million in employer and employee related taxes. The number of fully vested, non−forfeitable shares of

our common stock to be issued was determined by dividing the total consideration due (less the amount of applicable tax

withholdings) by the closing price of our common stock on October 24, 2002, of $10.46 per share.

The shares of our common stock issued in exchange for Eligible Options were fully vested. However, a portion of the shares equal to

25% of the total consideration, based on the closing price of our common stock on the offer termination date, have a six month

holding period, and a portion of the shares equal to 25% of such total consideration have a one year holding period. Withholding taxes

and other charges were deducted from the remaining 50% of the total consideration, and the shares issued after such withholding did

not have a holding restriction.